Consumer credit in Slovakia: surging despite interest rates above euro area average

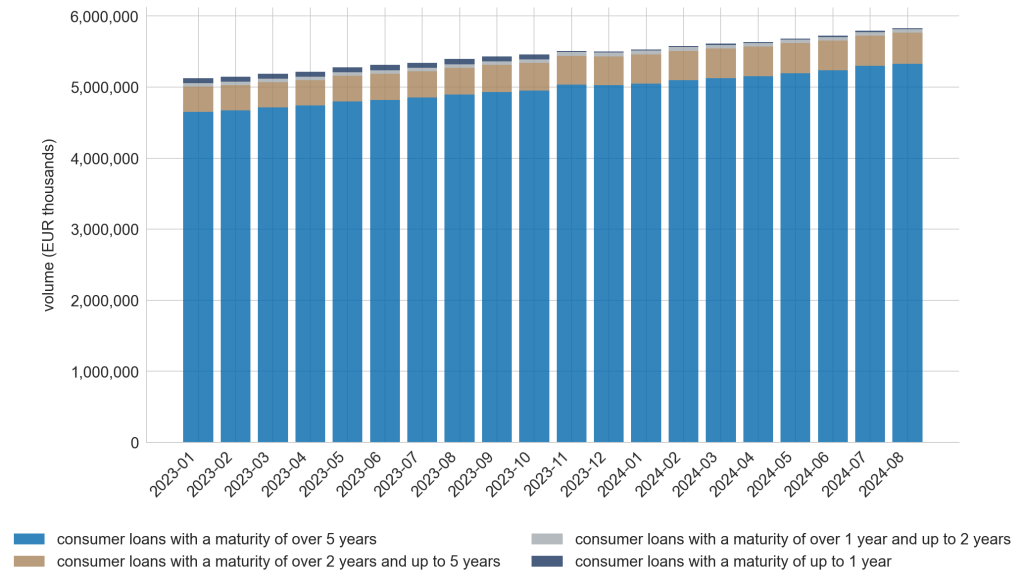

The outstanding amount of consumer loans in August 2024 increased by 8.10% compared with a year earlier. Consumer loans with a maturity of more than five years contributed most to this growth, followed by loans with a maturity of between two and five years (Chart 1).

The expected rise in prices and the gradual improvement in the financial situation of Slovak households contributed to the demand for consumer credit from banks [1].

Chart 1 Evolution of consumer loans by maturity (outstanding amounts)

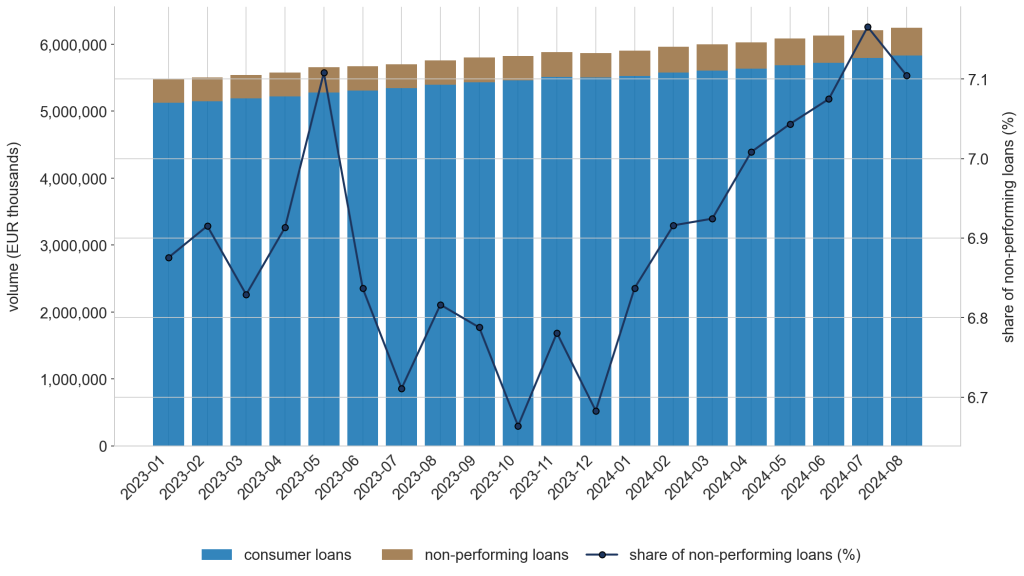

The share of non-performing loans in total loans to households reached 7.1% in August 2024, representing an increase of only 0.26 percentage points since the beginning of the year (Chart 2).

Chart 2 Share of non-performing loans (outstanding amounts)

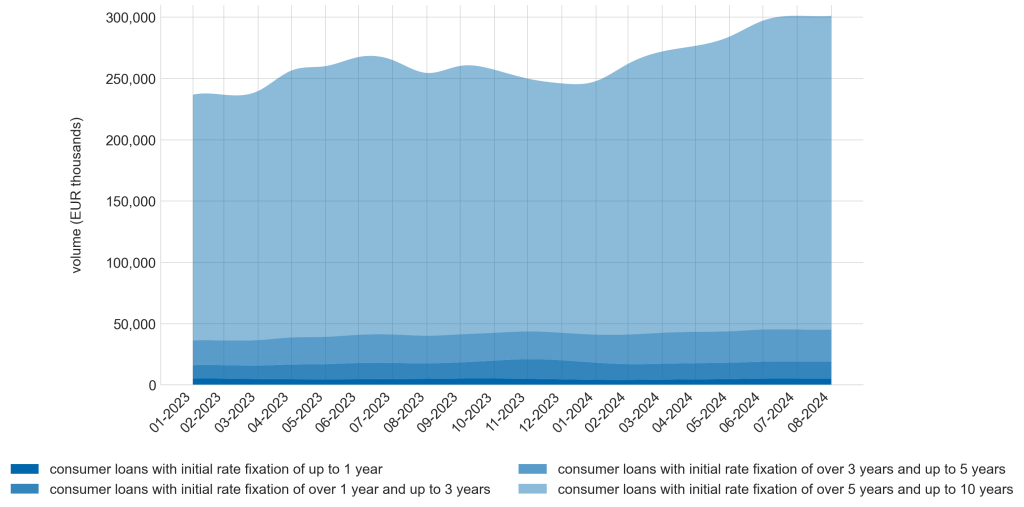

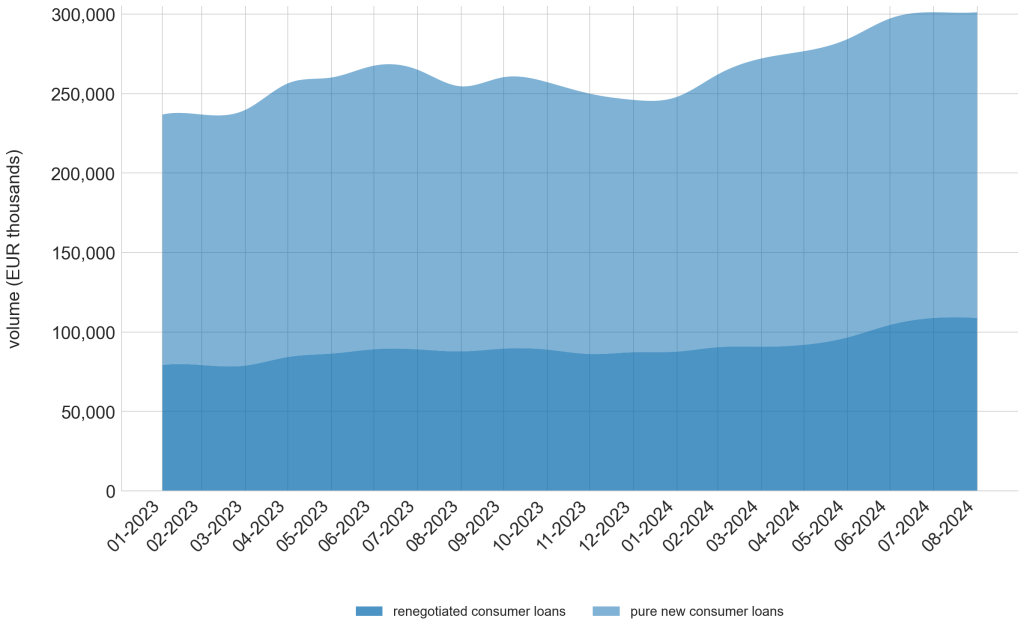

The volume of new consumer loans granted by banks to Slovak households in August 2024 amounted to around €293 mil. (Chart 3).

From January to August 2023, total new consumer loans grew by an average of 2.07% per month. From January to August 2024, their average monthly growth was 4.17% (a change of 2.1 pp). Most of this growth was accounted for by consumer loans with a fixed maturity of between five and ten years.

Chart 3 Evolution of new consumer loans by initial rate fixation (moving average)

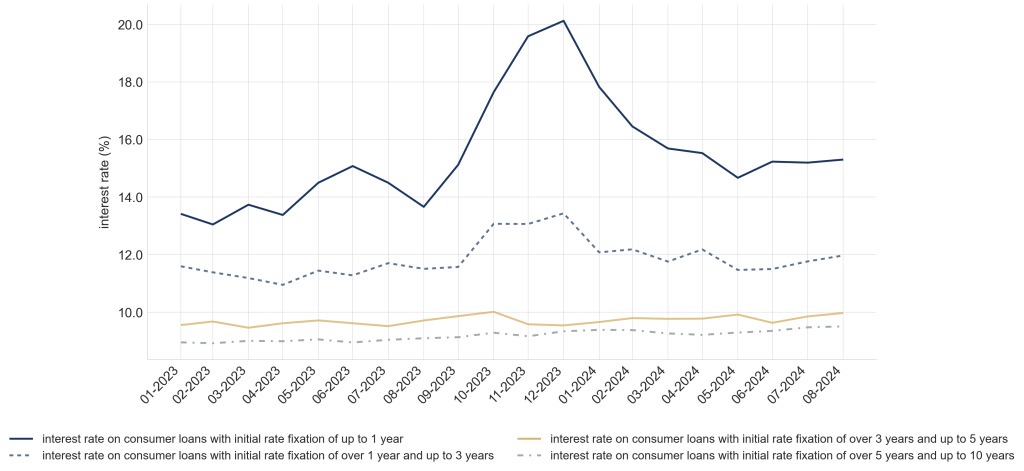

New consumer loans with an initial rate fixation of between five and ten years have long been offered by the banks with the lowest interest rates (Chart 4).

Chart 4 Interest rates by initial rate fixation (new loans)

As a share of consumer credit flows, pure new loans far outweigh renegotiated loans (Chart 5). Pure new loans accounted for 63.4% of total new loans in August 2024, while renegotiated loans accounted for 36.6%.

The average monthly increase in net new consumer credit was 3.98% from January to August 2024. Compared with the same period last year, this represents an increase of 2.2 pp (up from 1.78%).

Chart 5 Evilution of consumer credit flows by pure new loans and renegotiated loans (moving average)

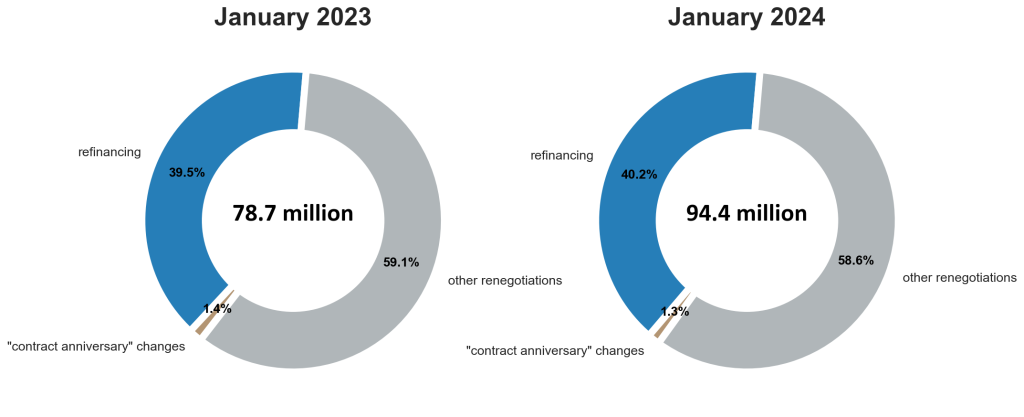

The volume of renegotiated loans was €15.7 million higher in January 2024 than in January 2023.

The structure of renegotiated consumer loans shows that renegotiations other than refinancing and ‘contract anniversary’ changes account for almost 60% of all types of renegotiations (Chart 6).

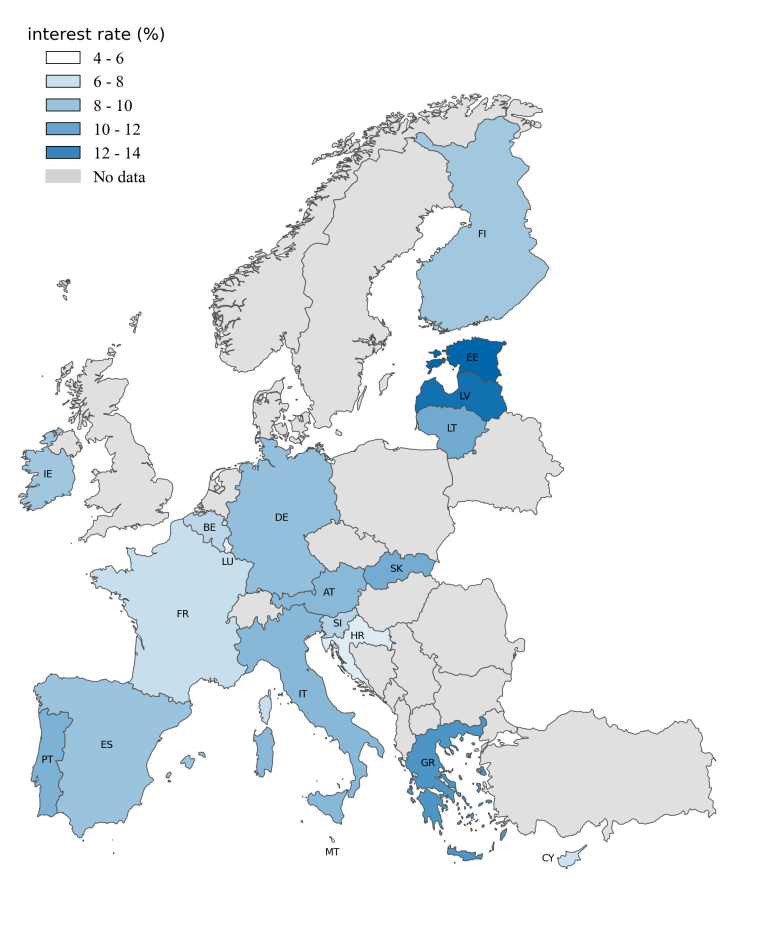

Consumer credit in Slovakia is among the most expensive in the euro area. In August 2024, the average interest rate on new consumer loans in Slovakia was 9.8%, while the euro area average was 7.8%. The cost of consumer borrowing is highest in the Baltic States and lowest in, for example, France, Belgium, Luxembourg, Croatia, Cyprus and Malta (Figure 1).

Figure 1 Comparison of interest rates on new consumer loans in the euro area (August 2024)

[1] Financial stability report – May 2024

If you have any questions, please do not hesitate to contact us at statistici@nbs.sk