-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary Policy Briefs

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

Monetary policy implementation

The Eurosystem implements monetary policy through an operational framework comprising monetary policy instruments and procedures. They are implemented in a uniform decentralised manner, i.e. through the European Central Bank (ECB) and Eurosystem national central banks (NCBs), including Národná banka Slovenska (NBS). At regularly scheduled meetings, the ECB’s Governing Council, including the NBS Governor, reviews the calibration of the individual instruments with the aim of pursuing its primary monetary policy objective of price stability. The Governing Council may also, where necessary, recalibrate its policy instruments at unscheduled meetings.

-

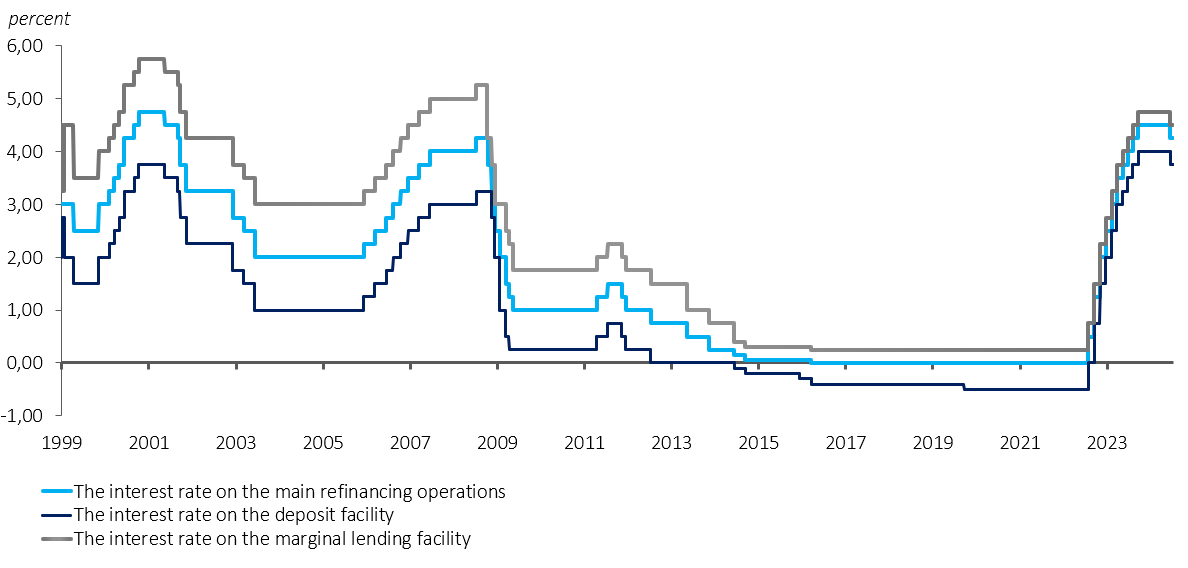

Marginal lending facility

Marginal lending facility offers overnight credit to banks at a pre-set interest rate above the main refinancing operations rate

-

Main refinancing operations

In main refinancing operations operations banks can borrow funds from the ECB against collateral on a weekly basis, at a pre-determined interest rate

-

Deposit facility

Deposit facility banks may use to make overnight deposits at a pre-set rate lower than the main refinancing operations rate

Ordinarily, the Governing Council’s most important decision concerns the level of the key interest rates at which commercial banks borrow from their central bank. Via the so-called transmission mechanism, these rates subsequently affect the level of interest rates in the economy. The Eurosystem’s key monetary policy rates are as follows:

The Eurosystem applies the key interest rates in standard instruments, i.e. open market operations and standing facilities, as specified in an ECB Guideline. These instruments are used to manage the amounts of funds necessary for the day-to-day liquidity of the euro area banking sector. As for the open market operations, main refinancing operations are used to manage short-term market interest rates and liquidity and to indicate the aims of euro area monetary policy. Longer-term refinancing operations (LTROs) are a means to provide additional, longer-term refinancing of the euro area financial sector.

Since the emergence of the global financial crisis in 2007, the ECB’s Governing Council has on a number of occasions introduced non-standard instruments and techniques, using them also to respond to subsequent developments and requirements, including during the pandemic crisis. These instruments include inter alia the following:

- a negative interest rate on the deposit facility, the so-called negative interest rate policy (NIRP);

- targeted longer-term refinancing operations (TLTROs) and non-targeted pandemic emergency longer-term refinancing operations (PELTROs);

- the asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP);

- forward guidance.