The most attractive deposits for Slovaks mature within one year

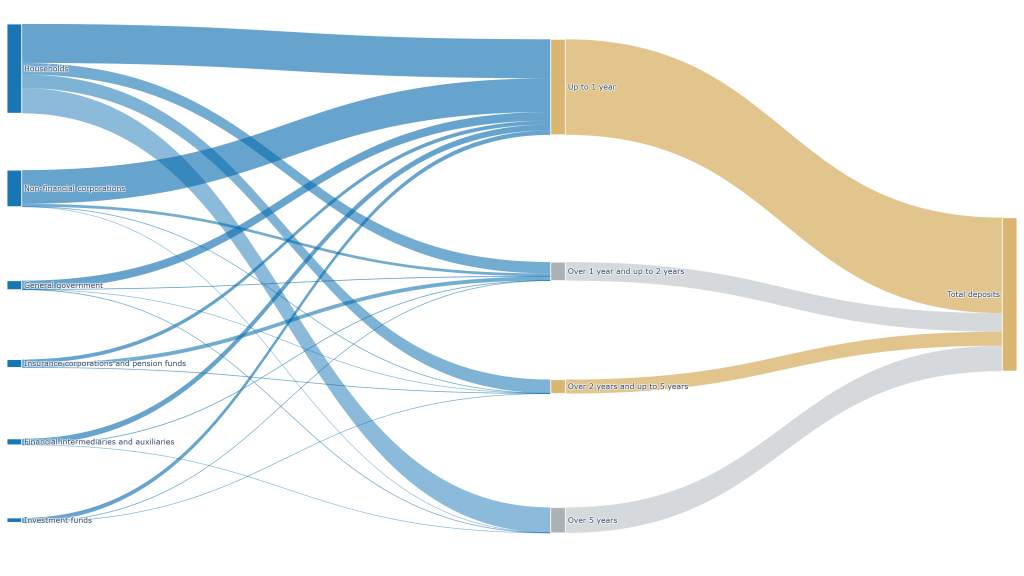

Total bank deposits with an agreed maturity held by Slovak residents amounted to €18 billion as of 31 December 2023. Most of these deposits are held by households and non-financial corporations (NFCs). In terms of maturity, the majority of deposits have an agreed maturity of up to one year.

Figure 1. Outstanding amount of deposits with an agreed maturity by selected sectors of Slovak residents as of 31 December 2023

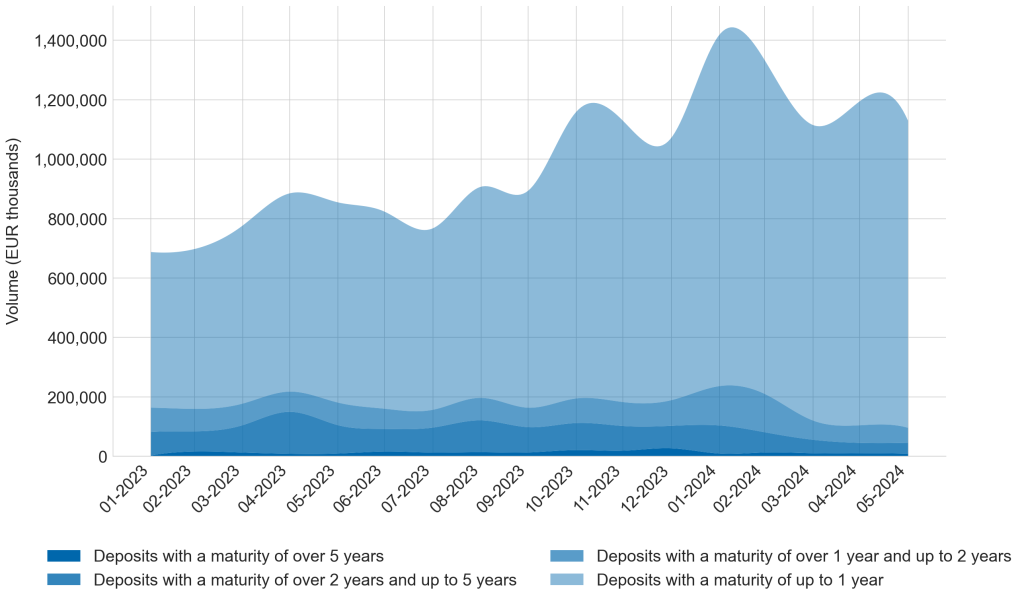

The combination of real wage growth in 2023 and the ECB’s interest rate policy change resulted in a notable increase in new deposits during the fourth quarter of last year. The highest volume of new deposits from the household sector was recorded in January 2024.

Further developments in the volume of new deposits at all maturities indicate a downward trend.

Chart 2. Evolution of new deposits of Slovak households by agreed maturity

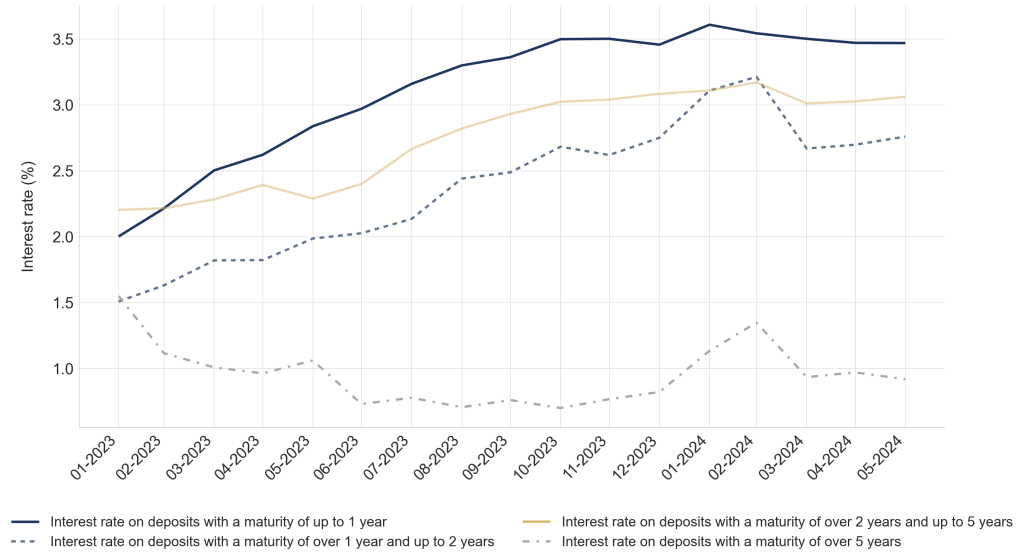

The average interest rate on new household deposits with an agreed maturity of up to one year was one of the highest in the euro area in December 2023, at 3.5%, while the euro area average was 3.3%.

The average interest rate on these deposits peaked at 3.6% in January 2024, when the euro area average stood at 3.2%. Since then, it has decreased slightly.

Chart 3. Interest rates on new deposits of Slovak households

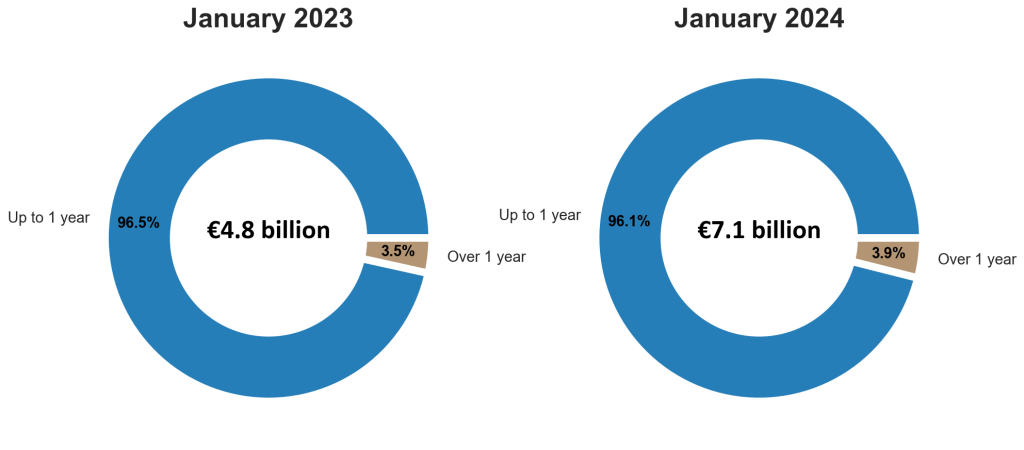

As for new deposits from non-banks (with agreed maturities of up to 1 year, from 1 to 2 years, from 2 to 5 years, and over 5 years), their total volume recorded a notable 48% year-on-year increase in January 2024, representing an absolute rise of €2.3 billion.

This increase was largely accounted for by new deposits from non-financial corporations, followed by new household deposits and new general government deposits.

Figure 4. New deposits with an agreed maturity held by non-bank residents in Slovakia – year-on-year comparison

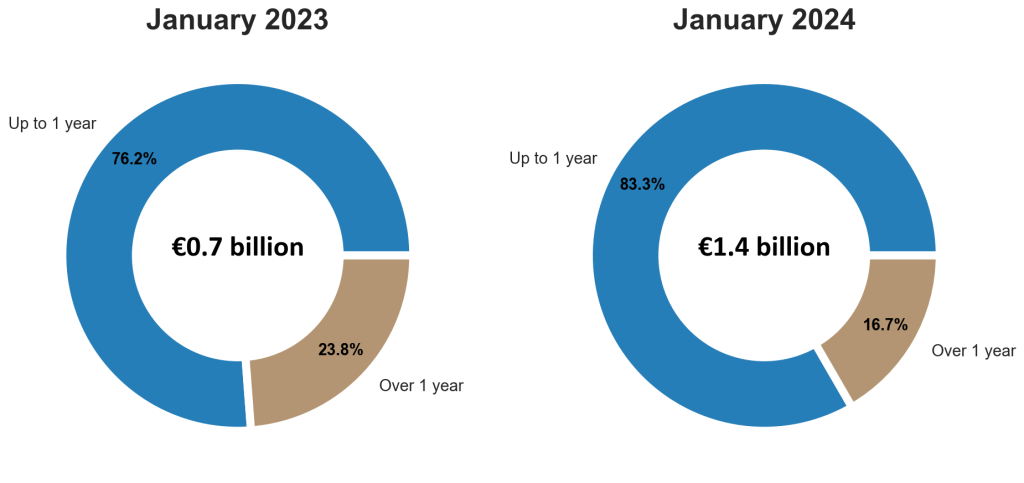

The volume of new deposits held by households doubled year-on-year (increasing by €0.7 billion in absolute terms). Most new deposits have an agreed maturity of up to 1 year, and this maturity’s dominant share increased by 7.1 pp between January 2023 and January 2024.

Figure 5. New deposits with an agreed maturity held by Slovak households – year-on-year comparison

Deposits with an agreed maturity of up to one year are the most commonly used by Slovak households.

Their favourable interest rates have been influenced by the ECB’s interest rate policy. The forthcoming changes in the ECB’s interest rate policy are beginning to be reflected in a downward trend in both the volume and interest rate of deposits with an agreed maturity.

If you have any questions, please do not hesitate to contact us at statistici@nbs.sk