-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary Policy Briefs

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

About the Resolution Council

The Resolution Council (‘the Council’) was established on 1 January 2015 as the national resolution authority in the Slovak Republic. The institutions that fall within the competence of the Council are credit institutions and those investment firms with share capital of at least € 730,000.

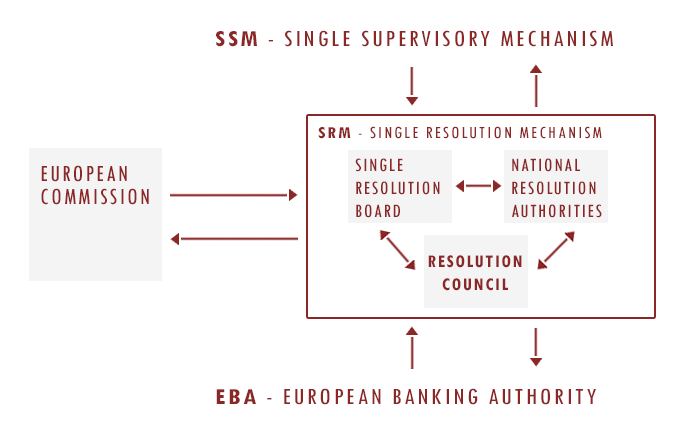

The Council is part of the Single Resolution Mechanism (SRM), which comprises:

- the Single Resolution Board, based in Brussels,

- the national resolution authorities of the euro area countries,

- the national resolution authorities of those other EU Member States that have opted to participate in the SRM.

The main objective of the Council is to prevent the failure of institutions and groups in the financial sector and, if failure cannot be avoided, to ensure their effective resolution, having regard to the preservation of financial stability and the protection of client assets of the given institution or group. It is therefore the Council’s task:

- to draw up resolution plans for institutions incorporated in Slovakia and to contribute to the drafting of resolution plans for groups that have a subsidiary incorporated in Slovakia,

- to comment on recovery plans of those institutions or groups,

- to assess the resolvability of institutions,

- to set minimum requirements for own funds and eligible liabilities (MREL) for individual institutions incorporated in Slovakia,

- to issue decisions under specific regulations in relation to institutions incorporated in Slovakia,

- to perform other activities relating to its participation in the SRM.

The Council was established as an independent public legal entity. It is composed of ten members. The task of providing expertise to, and organising the functioning of, the Council is performed by Národná banka Slovenska.