-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Carbon Footprint Report of NBS Climate-related disclosures of NBS non-monetary policy portfolios Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary

- Policy Briefs Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

Crowdfunding

What is crowdfunding?

Crowdfunding is a method of alternative finance for initiatives (projects) of individuals and companies.

It usually has the form of on-line campaigns and can be aimed at both non-profit and business activities. The term means raising funds from a large group of people (called ‘supporters’) in different ways for the purposes of financing the projects or business plans of specific persons (called ‘project owners’). Each supporter contributes a relatively small part of the total value that the project owner wishes to raise. Such raising of funds is often based on the ‘all or nothing’ principle, meaning that if the predetermined target amount is not raised, the funds are returned to the supporters.

Contents:

-

I. How does crowdfunding function in practice?

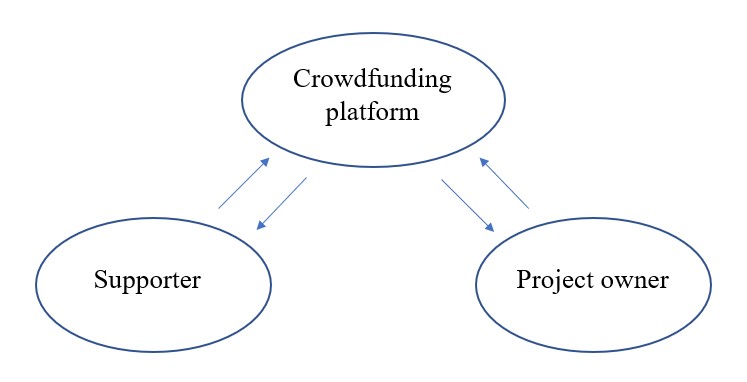

Crowdfunding involves the cooperation of three entities:

- A crowdfunding platform or its provider – an entity which establishes and operates a platform connecting the demand for a project funding with persons willing to provide funds for the purpose. Supporters may decide which project they wish to fund. A crowdfunding platform generally works on-line and usually provides a payment interface. It offers the services itself or through third parties. The operating rules of the platform are set by the provider.

- Supporters or investors – the persons who individually offer a relatively small amount of funds with the aim of collective raising a predetermined amount to support the funding of a certain project.

- Project owners – the persons asking the supporters to provide funds for their projects.

-

II. Types of crowdfunding

Relations between the crowdfunding entities depend on several factors related to the particular funding model used.

Depending on whether a supporter gets consideration for the funds provided, the nature of such consideration and the legal characteristics of the relations between the persons concerned, the forms of crowdfunding include mainly:

- a model without consideration – donation-based crowdfunding;

- models with consideration, which include

– rewards-based crowdfunding,

– lending,

– investment or equity crowdfunding - hybrid or combined models.

IIa. Crowdfunding without consideration

In this type of crowdfunding supporters usually contribute to a smaller scale project with the aim to support, for example, art, science, charity, or other projects beneficial to the public. The funds provided are donations and consequently the supporters do not expect any consideration from the person seeking contribution to their project.

IIb. Crowdfunding with consideration

This type includes several crowdfunding models in which the supporters are entitled to consideration from the person seeking contributions to their project.

Rewards-based model of crowdfunding

In this crowdfunding model the supporters usually receive a material (non-financial) reward for the funds provided; this could take the form of a product or service from the project owner.Lending

In the lending model, the supporters or investors provide interest-bearing group loans to particular persons, usually for their business activities. The process is coordinated by a crowdfunding platform. This crowdfunding type also includes providing loans in a ‘peer to peer’ way (also called ‘P2P’ or ‘person-to-person’). There are several methods in which offers and demands for such funding are matched in practice.In the fixed borrowing rate model, the interest rate of loans is determined by the platform administrator. If this is accepted by the person who wants to borrow, the loan is realised.

The auction model is characterised by the fact that the crowdfunding platform determines the maximum possible interest rate, and within the limit, investors make their own offers to the persons interested in borrowing funds (potential debtors). They publish their request for a loan, including information for example, on the purpose, amount and maturity of the loan, through the internet platform. Investors may offer a potential debtor the whole amount of the loan, or a part, for a specific interest rate. In both these types of lending, individual investors decide which of the offered areas or purposes to support with their loans.

Investment or equity crowdfunding

In this crowdfunding model, supporters become investors in the equity capital of the company (they acquire a stake in its business) or become co-owners of the company. The supporters are thus interlinked with the supported business entities and may be entitled to the exercise of voting rights, i.e. involvement in decisions concerning the company management, and may also be entitled to the payment of dividends from the company’s profit. -

III. Legislation

This regulatory framework consists of the Crowdfunding Regulation which applies from 10 November 2021 and a set of regulatory technical standards and implementing technical standards (Level 2 Legislation). The Level 2 Legislation should be adopted and published in the Official Journal of the EU in the near future.

The European Securities and Markets Authority (ESMA) has already published a Final report on Level 2 legislation under the Crowdfunding Regulation.

The types of crowdfunding regulated by the Crowdfunding Regulation are:

- crowdlending (facilitation of granting of loans) and

- crowdinvesting (facilitation of business financing via securities and admitted instruments for crowdfunding purposes).

According to the Crowdfunding Regulation the provision of crowdfunding services encompasses three types of actors:

- project owner who seeks funding through a crowdfunding platform (crowdfunding offers with a consideration of less than EUR 5 000 000); in terms of the Slovak Republic the Article No. 49 of the Crowdfunding Regulation should be taken into the account,

- investors who provide their capital/invest to proposed projects,

- crowdfunding services provider who operates a digital platform.

Only an authorised legal person can provide crowdfunding services under the Crowdfunding Regulation. The National Bank of Slovakia as the competent public authority of the Slovak republic is responsible for granting authorisation in relation to the Crowdfunding Regulation.

P2P (peer-to-peer) crowdfunding platforms, i.e. a crowdfunding model focused on facilitation of consumer loans, are out of the scope of this regulation