-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary Policy Briefs

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

Regulatory sandbox

is a platform that allows the participant via consultations with NBS to adjust financial innovation in compliance with regulation and practically test it on the Slovak financial market. The purpose of the platform is to facilitate the implementation of innovations in Slovakia.

The purpose of the platform is also to link the interest of Slovak supervised entities with the interest of FinTech companies. The NBS is therefore creating a Database of Interested Parties, where Slovak supervised entities can express a demand for cooperation.

The regulatory sandbox is open since 1 January 2022.

Contact: sandbox@nbs.sk

A participant in the regulatory sandbox may be

- the supervised entity

- the foreign supervised entity

- the applicant for authorisation

- the service provider

- the future supervised entity

Criteria to enter into the regulatory sandbox

- the applicant’s readiness to participate in the regulatory sandbox and readiness of financial innovation for testing

- the existence of the need for testing

- innovativeness

- positive impacts on clients in the Slovak financial market and the absence of significant negative impacts on financial stability in the Slovak Republic

The NBS assesses the fulfillment of all these criteria according to the Methodology for the assessment of the criteria to enter into the regulatory sandbox .

The NBS will allow the applicant to enter into the regulatory sandbox if

- the applicant is of good repute

- the subject of the consultation will be the application of legislation within the competence of the NBS

- the applicant meets all the criteria to enter into the regulatory sandbox

How does it work?

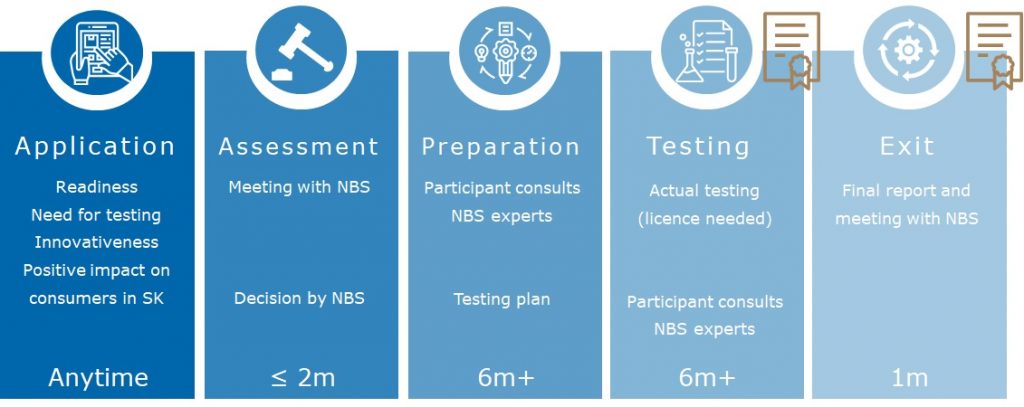

Participation in the regulatory sandbox has these phases

-

Preparatory phase

- enables the participant to have consultations with the NBS, which should help the participant to adjust financial innovation in compliance with the legislation within the competence of the NBS

- determines the course of the testing phase in the form of a testing plan

- lasts a maximum of 6 months (the NBS may extend it accordingly if necessary)

-

Testing phase

- enables implementation of the tested financial innovation on the Slovak financial market in accordance with the testing plan

- the participant continuously informs the NBS about the course of testing in accordance with the testing plan

- testing period shall not exceed 6 months (the NBS may extend it accordingly by a maximum of 6 months if necessary)

-

Termination of participation in the regulatory sandbox

- within one month after the end of the testing, the participant delivers to the NBS the final report

- within one month from the delivery of the final report, the NBS organizes a final meeting with the participant in order to discuss the final report and the course of the participant’s participation in the regulatory sandbox

- the NBS may replace the final meeting with a written statement on the final report

- participation in the regulatory sandbox is terminated on the day of the final meeting or on the day of delivery of the NBS’ written statement on the final report

- participation in the regulatory sandbox may also be terminated prematurely, both by the participant and by the NBS

The application for the regulatory sandbox

- the applicant delivers the application to the NBS in paper (.docx) or electronic form

- the NBS confirms the delivery of the application to the applicant and assesses its formal and content requirements, the NBS may call on the applicant to eliminate shortcomings or supplement the application

- the NBS convenes an information meeting with the applicant in order to obtain more detailed information regarding the applicant and the application

- the NBS notifies the applicant within two months from the date of delivery of the complete application whether it will allow him to enter into the regulatory sandbox (the time limit does not apply to the entity interested in cross-border testing)

FAQ

-

How to deliver the application to the NBS?

The application to the regulatory sandbox can be delivered to the NBS

by filling in an electronic form

po after sending the form, the NBS confirms its receiptor

completed application (.docx)

send electronically to the email address sandbox@nbs.sk;

or in paper form to the postal address:National Bank of Slovakia

Financial Technology and Innovations Department

Imricha Karvaša 1

813 25 Bratislava

-

What is the difference between the innovation hub and the regulatory sandbox?

The innovation hub and the regulatory sandbox are two tools that enable interested parties to have a dialogue with the NBS on the application of regulation within the NBS’s competence to financial innovation.

The innovation hub serves primarily to answer one or more specific questions about the application of regulation to financial innovation. After answering these questions, the interaction within the innovation hub is terminated.

The regulatory sandbox is used for repeated consultations regarding the adjustment of financial innovation and its subsequent real testing on the financial market under the scrutiny of the NBS. Cooperation within the innovation hub is usually one-off, while cooperation within the regulatory sandbox lasts several months. For this reason, there are usually way more interactions via the innovation hub than there are participants in the regulatory sandbox.

-

Why apply to the regulatory sandbox?

Thanks to participation in the regulatory sandbox, the participant will have the opportunity to consult with the NBS on the compliance of financial innovation with regulation. Based on consultations with experts from the NBS, the participant can adjust financial innovation and then test it on real clients in the Slovak financial market in accordance with the testing plan.

-

When is it possible to apply?

The application for the regulatory sandbox can be submitted at any time during the year.

-

How is participation in the regulatory sandbox terminated?

Termination of participation in the regulatory sandbox may be regular or premature.

Premature termination of participation in the regulatory sandbox

The participant may terminate its participation in the regulatory sandbox prematurely at any time on its own initiative, but it must inform the NBS about it in advance. The NBS may also terminate the participant’s participation in the regulatory sandbox prematurely if the participant does not follow the NBS instructions.Proper termination of participation in the regulatory sandbox

Within one month after the end of the testing, the participant delivers a final report to the NBS summarizing the testing process. Within one month of the delivery of the final report, the NBS organizes a final meeting with the participant in order to discuss the final report and the course of its participation in the regulatory sandbox. The NBS may replace the final meeting with a written statement on the final report. Participation in the regulatory sandbox is terminated on the day of the final meeting or on the day of delivery of the NBS’ written statement on the final report.

-

What are the conditions for cross-border testing in several regulatory sandboxes?

The first step in cross-border testing is to complete a form on the EU Digital Finance Platform, in which the entity specifies in more detail what type of cross-border testing it is interested in and which supervisors it wants to involve in the testing.

Subsequently, an entity that is interested in cross-border testing in multiple regulatory sandboxes (Multi sandbox testing) should submit an application both to the NBS regulatory sandbox and to all other regulatory sandboxes in which it wishes to test. The entity interested in cross-border testing must meet the criteria for entry into other regulatory sandboxes according to the relevant rules of that regulatory sandbox.

After expressing interest in cross-border testing, the NBS communicates with other relevant supervisory authorities and agrees with them on further action in connection with cross-border testing. Therefore, a two-month period does not apply to the assessment of such an entity’s application.

-

What information does the NBS publish about the participant?

The NBS publishes the participant’s business name, the date of entry of the participant into the regulatory sandbox, the start date of testing, the date of suspension of testing, the end date of testing, the date of termination of participation, and a brief description of the tested financial innovation. With the consent of the participant, the NBS may also publish more detailed information on the participant’s participation in the regulatory sandbox.

Cooperation with FinTechs

Many supervised entities and FinTechs are interested in cooperating in the implementation of financial innovations, but often do not know about each other. The NBS is therefore creating a Database of Interested Parties, where Slovak supervised entities may express an interest in cooperating with FinTechs.

Sign up for cooperation with FinTechs!

If you are a Slovak supervised entity and you are open to cooperation with service providers *, please fill in the contact electronic form.

* The service provider is a third party that on the basis of an outsourcing agreement concluded with the supervised entity, applies a procedure, provides a service, or performs an activity or part thereof for which the supervised entity is authorised according to legislation.

FinTechs interested in cooperating with Slovak supervised entities can directly contact supervised entities listed in the Database.