-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Carbon Footprint Report of NBS Climate-related disclosures of NBS non-monetary policy portfolios Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary

- Policy Briefs Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

Robo-advice

Introducing robo-advice

Robo-advice means the provision of investment advice or portfolio management services (in whole or in part) through an automated or semi-automated system used as a client-facing tool.

Types of robo-advice:

- investment advice (including, for example, investment advice by means of signalling);

- portfolio management services provided, for example, by means of automated portfolio management (signal trading, social trading, PAMM).

Contents

-

I. Automated investment advice

The operator of a digital platform makes it possible for their clients (investors) to access, primarily through an Internet interface, suitable investment recommendations in relation to one or more transactions in financial instruments (e.g. recommendations regarding a set of financial instruments contained within a model portfolio).

The operator of the digital platform interacts with their clients using an automated or semi-automated system, meaning that personal interaction between the employees of the digital platform’s operator and their clients is limited or non-existent.

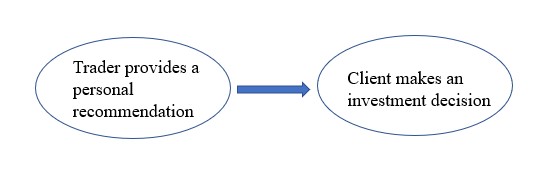

The investment recommendation provided, however, has the form of a personal recommendation addressed to a specific client. This recommendation is based on an evaluation of the client’s personal circumstances and is primarily the result of mathematical calculations or algorithms executed by or on behalf of the operator of the digital platform.

Personal recommendations are provided to the clients using mainly Internet-based distance communication methods (e.g. mobile applications or e-mail messaging). The investment decision itself (e.g. a decision to buy, sell or hold a financial instrument) is made exclusively by the client, including the physical submission of a specific order related to a financial instrument.

Ia. Automated investment advice by means of signalling

The operator of a digital platform generates signals in the form of personal recommendations. These are based on pre-defined procedures (algorithms) that include primarily mechanisms for technical, fundamental or economic analysis and/or a combination thereof. Signals are addressed to clients automatically or based on the decision of a person empowered by the operator of the digital platform. These recommendations are presented as suitable for a specific client and, most frequently, focus on the decision to buy, hold or sell a particular financial instrument.Where the provided recommendation relates to a particular financial instrument and bears the characteristic features of a personal recommendation, this type of automated or semi-automated advice constitutes the provision of investment advice, i.e. a regulated investment service subject to a set of clearly defined regulatory requirements.

-

II. Automated portfolio management

The operator of a digital platform or its user, acting as portfolio managers, perform, at their own discretion, management of a portfolio of financial instruments owned by other persons, i.e. their clients.

These decisions are made by the portfolio managers based on and in accordance with authorisations granted by their clients.

Portfolio management is therefore characterised by the exercise of portfolio managers’ own judgement in making investment decisions with respect to the managed financial instruments of their clients.

Where a portfolio manager provides this service through an automated trading system or through a system that allows algorithmic trading, the output of this system’s algorithm in the form of an investment decision and the submission of an order relating to a particular financial instrument is also deemed to result from the portfolio manager’s own judgement.

IIa. Signal trading

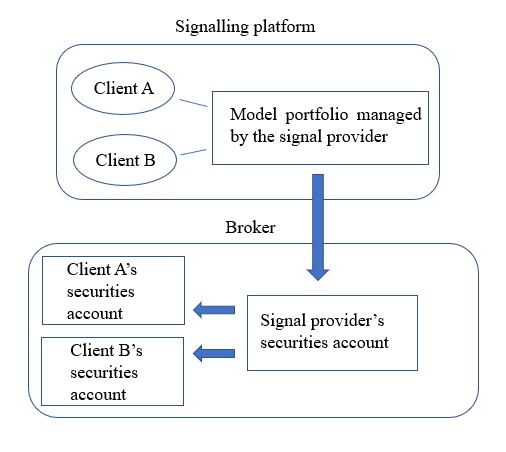

Signal trading or social trading is one of the methods of automated or semi-automated portfolio management. The operator of a digital signalling platform makes it possible for persons who manage their own assets allocated in a portfolio of financial instruments, a so-called signal provider, to make their reference portfolios viewable, usually through an Internet interface, to investors, i.e. clients of the platform. Thus, investors can follow and copy investment decisions made by the signal provider.

This ‘copying’ of investment decisions is possible because clients of the platform link their own portfolios with one or more reference portfolios of the signal provider using securities accounts which are usually kept by the same broker. The operator of the digital platform and the broker ensure that investment decisions made by signal providers are passed on to the broker as orders for execution. Identical investment decisions are then automatically executed also on the platform client’s securities account kept by the broker. The operator of the digital platform may receive a commission for forwarding the order to the broker. The signal provider usually receives a commission from the operator of the platform for making their investment decisions in the reference portfolio viewable for the public.

In this context, the digital platform operator’s activities include provision of a regulated investment service. The reason for this is the relevant contractual relationship between the operator and its clients. Also, it is the operator of the digital platform who turns the investment decisions of the signal provider into orders related to a financial instrument for the platform’s clients and who subsequently passes them on to the broker for execution. The operator of the digital platform is obliged to ensure, inter alia, that the provided investment service is suitable for the client. This obligation is put into practice by performing a suitability test.

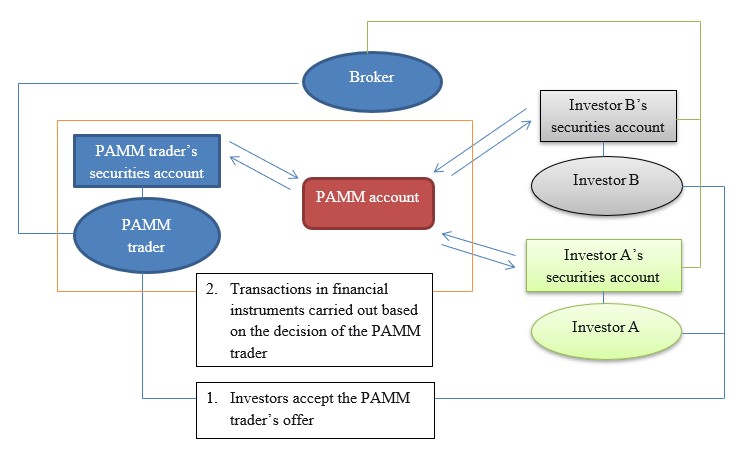

IIb. PAMM

PAMM (percent allocation management module) is one of the methods of automated or semi-automated portfolio management. It constitutes voluntary pooling of the assets of at least two investors with independent securities accounts into a single securities account, also called a PAMM account. The objective is to carry out transactions in financial instruments, mainly foreign exchange derivatives. One of the investors supplying assets allocated in the PAMM account, and at the same time the owner of the account, is the PAMM account manager or the PAMM trader. This person manages the PAMM account at their own discretion and receives a previously agreed commission paid usually by the individual investors in the PAMM account.

As the provider of the PAMM functionality, a broker is directly responsible for its design. Depending on the objectives and decisions of the provider, this can result in different versions of the functionality. The broker is responsible for maintaining the investors’ securities accounts and for calculating and distributing the profits/losses from the executed transactions among the investors. The calculation of profit/loss distribution is based on pre-determined criteria, primarily on the ratio of the investors’ initial investment in the PAMM account and on the previously determined commission for the PAMM trader.

When providing a portfolio management investment service, a PAMM trader can use a system to identify suitable opportunities to enter or exit investment positions while the design of this or similar systems may also allow algorithmic trading in financial instruments.

-

III. Legislation

Robo-advice (when providing investment advice or portfolio management services) is subject to a set of regulatory requirements laid down, primarily, in the following legal regulations:

- Act No 566/2001 on securities and investment services (and amending certain laws) (the Securities Act), as amended;

- Act No 186/2009 on financial intermediation and financial advisory services (and amending certain laws), as amended;

- Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council as regards organisational requirements and operating conditions for investment firms and defined terms for the purposes of that Directive;

- Guidelines on certain aspects of the MiFID II suitability requirements of 6 November 2018 (ESMA35-43-1163);

- Guidelines on MiFID II product governance requirements of 5 February 2018 (ESMA35-43-620);

- Questions and Answers on MiFID II and MiFIR investor protection and intermediaries topics of 3 October 2018 (ESMA35-43-349).