-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Carbon Footprint Report of NBS Climate-related disclosures of NBS non-monetary policy portfolios Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary

- Policy Briefs Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

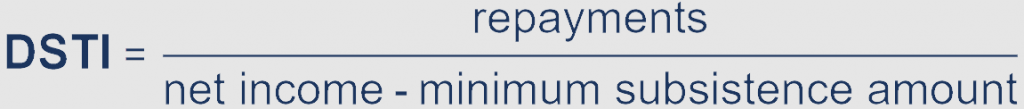

Debt service-to-income (DSTI) ratio

The limit on the DSTI ratio, an indicator of debt repayment ability, creates income buffers. This limit reduces the risk of loan default, especially during times of crisis. It protects both borrowers and lenders.

Limits

A loan may not be granted if the household’s resulting loan repayments, including repayments on any other loans, would exceed 60% of its income. The repayment total is calculated using a stressed interest rate. The household’s income is its income less the minimum subsistence amount.

Exemption

- For up to 5% of new loans, the DSTI ratio may be between 60% and 70%

- For up to a further 5% of consumer credit with a maturity of up to five years, the DSTI ratio may be between 60% and 70%

- Under Slovakia’s recovery and resilience plan, the monthly repayments of consumer credit granted for the energy-saving renovation of single-family houses can be reduced by €50

-

Additional exemptions

- The periods over which compliance with the exemptions is checked are the first and second halves of the year. In a given quarter, the exemptions may amount to up to 7% of new loans

- For consumer credit to low-debt households (with a debt lower than one-year’s income), the DSTI ratio may be up to 100%

- For leases to low-debt households (with a debt lower than one and a half year’s income) with a down payment of 20%, the DSTI ratio may be up to 100%

Calculation

| Repayments | Repayment on new loan Repayments on existing loans (including 3% of credit card and overdraft loans) Other financial liabilities |

| Net income | Income after contributions and taxes (documented and independently verified) |

| Minimum subsistence amount | Minimum subsistence amount per borrower, spouse and children (pursuant to Act No 601/2003 on the minimum subsistence amount) |

The repayment amount is calculated using a stressed interest rate, i.e. a buffer against an interest rate shock.

-

Calculation details

- An interest rate buffer of 2 percentage points above the applicable rate (up to a rate of 6%) under assumption of 30 years maturity. The DSTI calculation uses whichever repayment is higher – the actual repayment or the repayment subject to the interest rate shock

- The calculation is made for new and existing loans with a maturity of more than eight years

- Where the interest rate fixation period is more than ten years, an interest rate buffer of 1 percentage point suffices

- Where the interest rate is fixed for the duration of the loan, no interest rate buffer need be applied

To document and independently verify the income of loan applicants, lenders rely mainly on applicants providing a confirmation of income from their employer, a bank statement, a tax return, and proof of social benefits; lenders may also contact the Social Insurance directly to verify relevant information.

-

Illustrative calculation

A married couple with two children and a total net income of €2,200 apply for a housing loan with an interest rate of 3.7% and a maturity of 30 years.

Joint net income €2,200.00 Minimum subsistence amount (until 30 June 2026) €741.83 Difference between net income and the minimum subsistence amount €1,458.17 Maximum repayment (60% of the difference) €874.90 The loan repayment including an interest rate buffer (i.e. with the interest rate raised by 2 pp, up to a rate 6.0%) may not exceed €874.90.

The maximum loan amount is €150,741.10 and the actual loan repayment amounts to €693.84.

Legislation

The statutory framework comprises the Housing Loan Act and Consumer Credit Act.

In addition, Národná banka Slovenska has laid down detailed provisons on the DSTI calculation and DSTI limits in the Housing Loan Decree and Consumer Credit Decree.

Further information can be found in financial stability legislation.