Do you know the difference between renegotiated and refinanced loans?

You may have heard about new, pure new and renegotiated loans. You may not, however, be aware of the differences between them. In the context of loans, the terms ‘renegotiated’ and ‘refinanced’ are often confused. Using detailed data since January 2023, we can show you how the two differ.

The following figures and charts provide a clear and simple explanation.

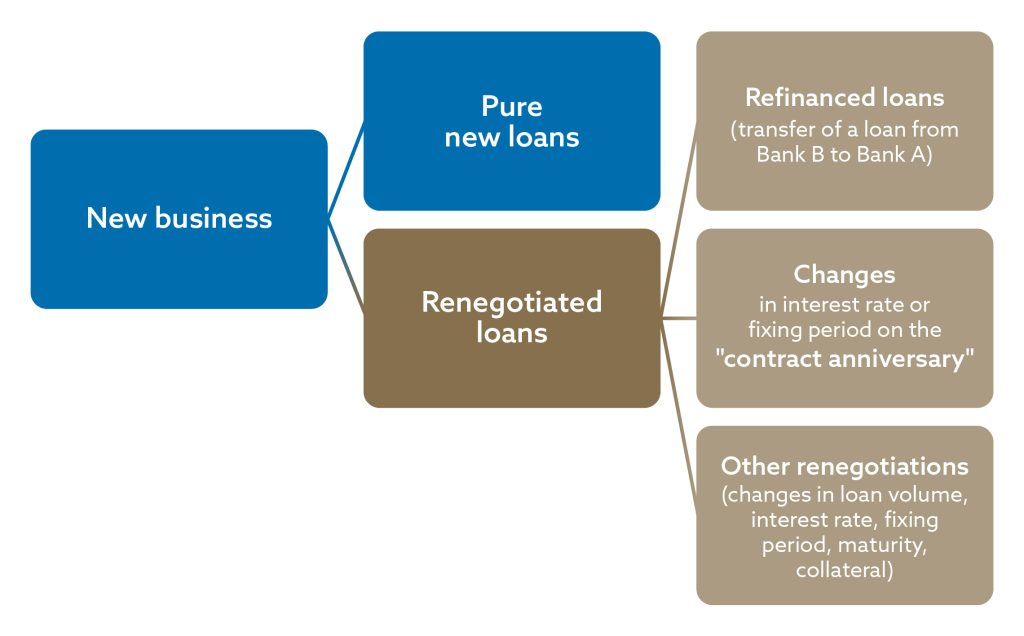

The first crucial point to understand is that a bank’s “new business” in a given month is defined as the loan contracts the bank signs with customers in that month.

Renegotiated loans are created where new terms and conditions are negotiated for an existing loan contract, and they include the sub-category of refinanced loans.

The total volume of renegotiated loans and completely (pure) new loans originated in a given month constitutes the ‘new business’ in that month, and the current interest rate on new business can be calculated accordingly.

Pure new loans = new business – renegotiated loans

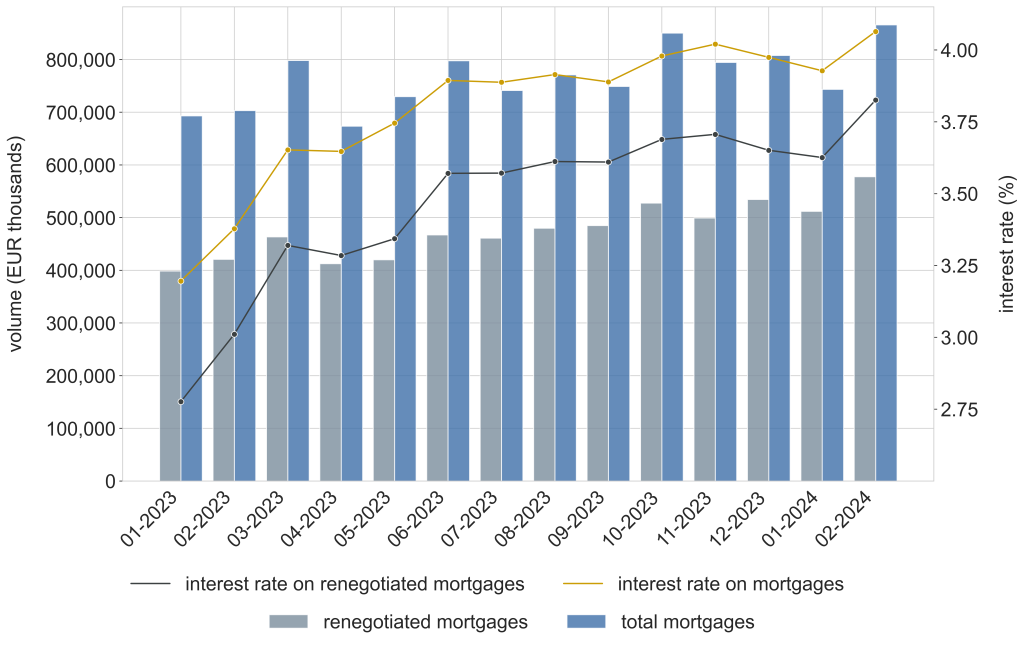

Let’s examine the specific data regarding mortgages for Slovak households. What do the figures reveal?

The volume of new mortgages has been increasing year-on-year, with the share of renegotiated loans in that growth exceeding the share of pure new loans. In January 2024 renegotiated loans accounted for 69% of new mortgage business.

This trend reflects the impact of the ECB’s monetary policy tightening, especially in 2023, as the resulting higher interest rate environment has made households less inclined to apply for a new mortgage and rather opt to renegotiate their existing loans.

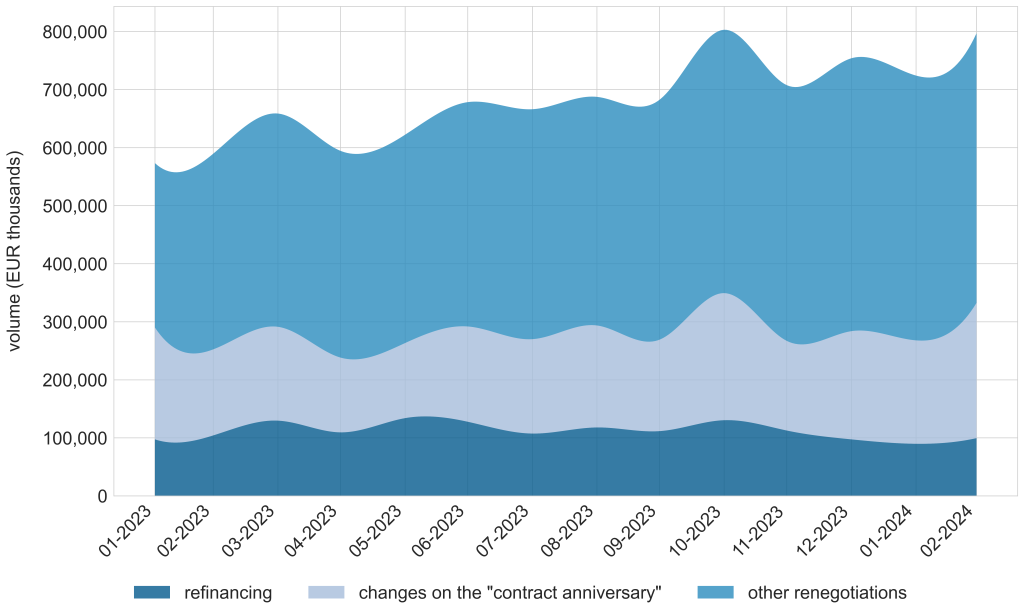

Chart 1. Renegotiated loans as a category of new mortgages (cumulative value per month) and the respective interest rates

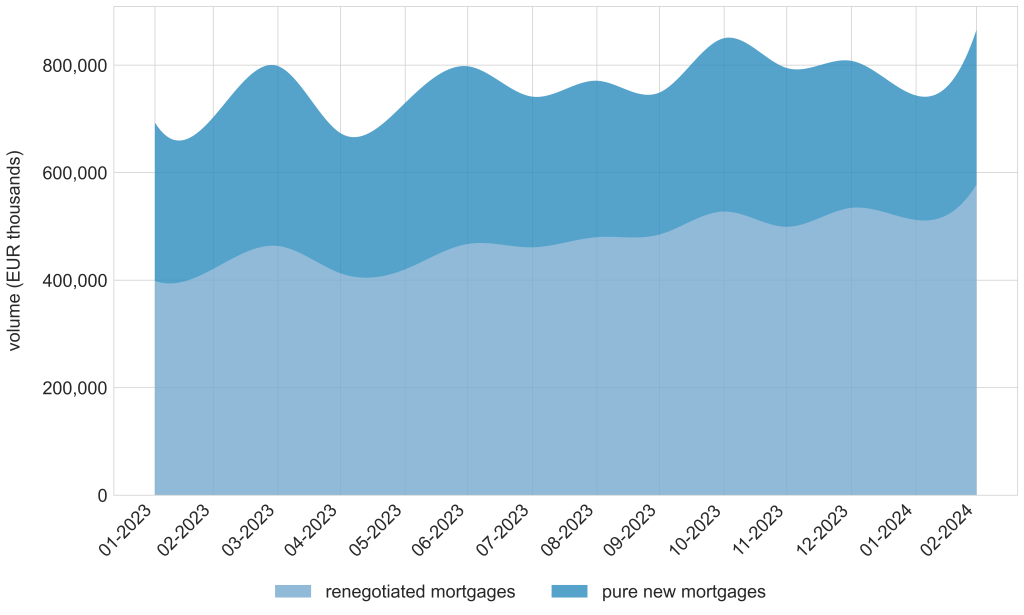

Chart 2 provides further insight into this trend in the evolution of renegotiated loans.

Chart 2. Pure new mortgages and renegotiated mortgages

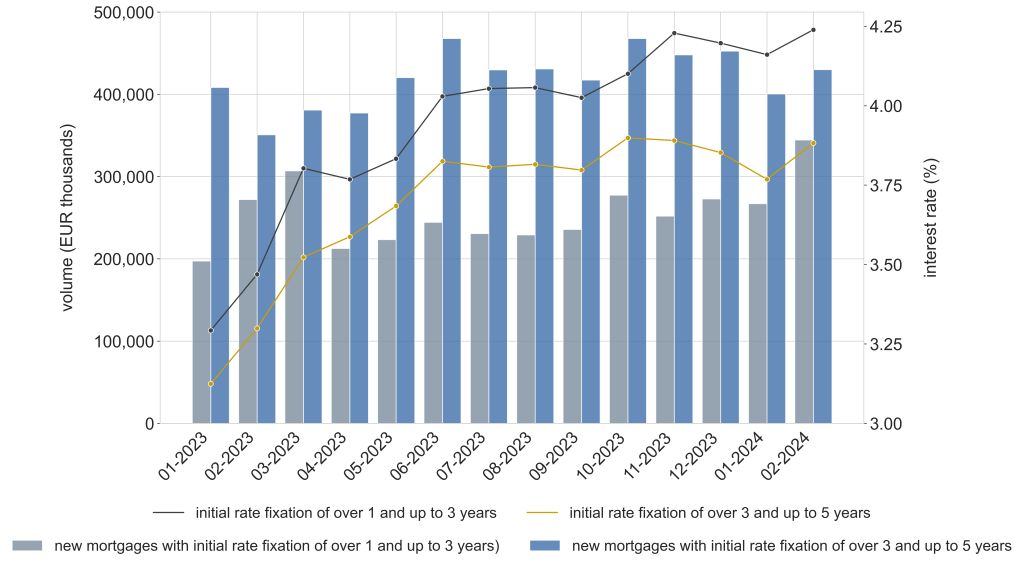

As regards the interest rate fixation periods offered by banks, Slovak households preferred mortgages with a fixation period of 3 to 5 years (in January 2024, they accounted for 53.9% of mortgages), followed by those with a fixation period of 1 to 3 years (35.9%).

Chart 3. New mortgages by interest rate fixation

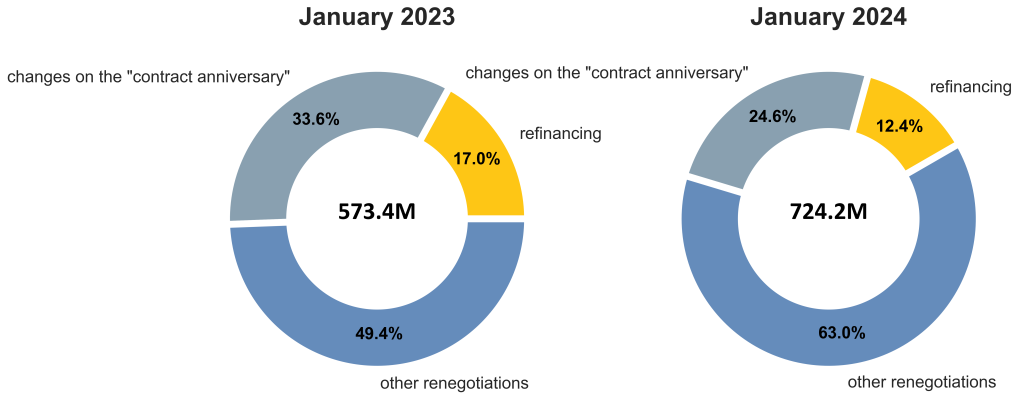

Chart 4 and Figure 5 give a detailed up-to-date overview of the renegotiated loan portfolio.

It is clear that the number of Slovak households seeking to refinance their mortgages is low. Mortgage borrowers have become less inclined to shop around banks for better credit conditions, including a better interest rate.

Where loans are renegotiated, it is most often in order to change the loan maturity, the rate fixation period, the interest rate or the loan collateral.

The remainder of renegotiated loans are loans where changes are made on the ‘anniversary’ of the loan contracts and may include the possibility of extending the loan maturity.

Figure 4. Categories of renegotiated loans

Figure 5. Year-on-year comparison of renegotiated loans

Conclusion:

Refinanced loans are part of renegotiated loans. Due to interest rate trends and housing market conditions, refinanced loans are currently the least preferred by bank customers.

Renegotiating the terms of existing loan agreements for mortgage loans is much more widely used by Slovak households than applying for completely (pure) new loans.

If you have any questions, please do not hesitate to contact us at statistici@nbs.sk