Statement from the NBS Bank Board’s 8th meeting of 2024

On 23 April the Bank Board of Národná banka Slovenska held its 8th meeting of 2024, chaired by NBS Governor Peter Kažimír.

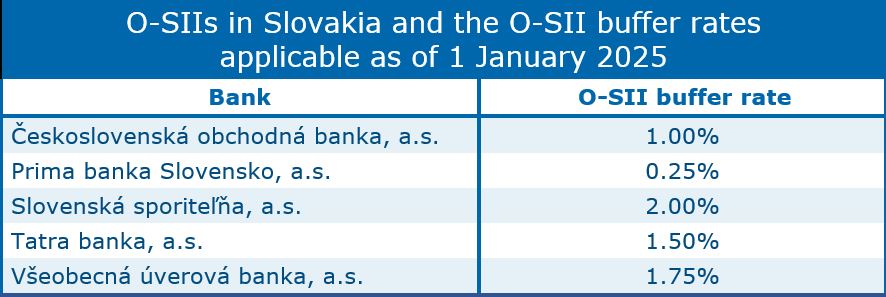

The Bank Board adopted an NBS Decision designating the banks that will be categorised as ‘other systemically important institutions’ (O-SIIs) in 2025 and an NBS Decision calibrating the level of the buffer rates that will be applied to O-SIIs as of 1 January 2025, as shown in the following table:

Source: NBS

Note: O-SII – locally system important banks

The Decisions take effect on 1 January 2025. Further information on these buffer rates will be published in the Decisions themselves and in the Bank’s ‘Commentary on the Decisions designating domestic systemically important banks and calibrating their capital buffers’, to be published on the Bank’s website.

The Bank Board discussed and approved an amendment to the NBS Decision amending NBS Decision No 2/2015 on the implementation of the Eurosystem monetary policy framework in the Slovak Republic, as amended. The amendment introduces changes arising from amendments to ECB legal acts that implement the Eurosystem monetary policy framework, adopted by the ECB’s Governing Council on 8 February 2024. These amendments are aimed at streamlining the counterparty framework and the eligibility criteria for assets used as collateral in Eurosystem credit operations, and they feature a number of changes of a technical and operational nature. In addition, the amending Decision includes updated versions of framework agreements on collateralised credit operations and on collateralised foreign-currency credit operations concluded between the Bank and its counterparties.

National Bank of Slovakia

Communications Section

Imricha Karvaša 1, 813 25 Bratislava

Contact: press@nbs.sk

Reproduction is permitted provided that the source is acknowledged.