-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Carbon Footprint Report of NBS Climate-related disclosures of NBS non-monetary policy portfolios Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary

- Policy Briefs Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

SEPA Credit Transfer

The Single Euro Payments Area (SEPA) allows customers to make cashless euro payments to anywhere in the European Union, as well as several non-EU countries, in a quick, safe and efficient way, just like national payments. By increasing competition between providers of payment services and payment card services, SEPA has benefited consumers and firms, who now have a broader choice of payment services driven by technological innovation.

Consumers and firms can make cashless euro payments within one SEPA country or between different SEPA countries and these payments are subject to the same conditions, rights and obligations regardless of the SEPA country in which the payment account is held.

SEPA payments can be made through SEPA payment instruments, i.e. SEPA credit transfers and SEPA direct debits, or through payment cards.

Useful links:

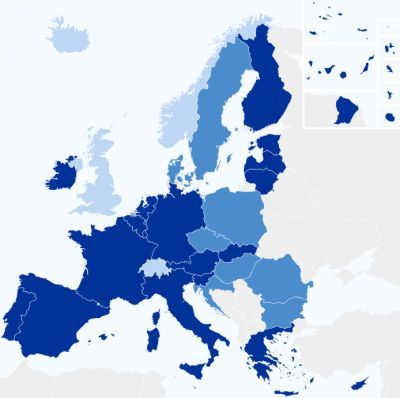

The SEPA region, in which harmonised payment standards apply to cashless euro payments, currently consists of 36 European countries, including all European Union countries and several non-EU countries. However, the legislation governing SEPA applies only to EU countries.

SEPA countries (status: 1 March 2019):

- 27 European countries, plus

- the United Kingdom

- Iceland

- Norway

- Liechtenstein

- Switzerland

- San Marino

- Monaco

- Andorra

- the Vatican City State

SEPA credit transfers (SCTs) and SEPA direct debits (SDDs) were introduced in 2008 and 2009 respectively. For euro area countries, the SEPA migration end-date was 1 August 2014, while for non-euro area EU countries, it was 31 October 2016.

As of these dates national credit transfers and direct debits were replaced by SEPA payment instruments.

In Slovakia, all credit transfers, including domestic transfers, have been processed as SCTs since 1 January 2014, and all direct debits have been processed as SDDs since 1 February 2014.

SEPA credit transfers (SCTs)

A credit transfer is a payment initiated by the payer. The payer gives a payment order to its payment service provider (PSP), for example a bank. The payer’s PSP then transfers the funds to the beneficiary’s PSP. The implementation of SCTs included converting bank account numbers to the IBAN format for all credit transfers and direct debits.

Useful links:

European Payments Council (EPC)

The legislative framework for SEPA is laid down by Regulation (EU) 260/2012 establishing technical and business requirements for credit transfers and direct debits in euro and amending Regulation (EC) 924/2009.

A further legal basis of SEPA payments is provided by the Second Payment Services Directive (PSD 2) which is transposed into Slovak law by Act No 492/2009 on payment services.