-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary Policy Briefs

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

The impact of monetary policy on the economy

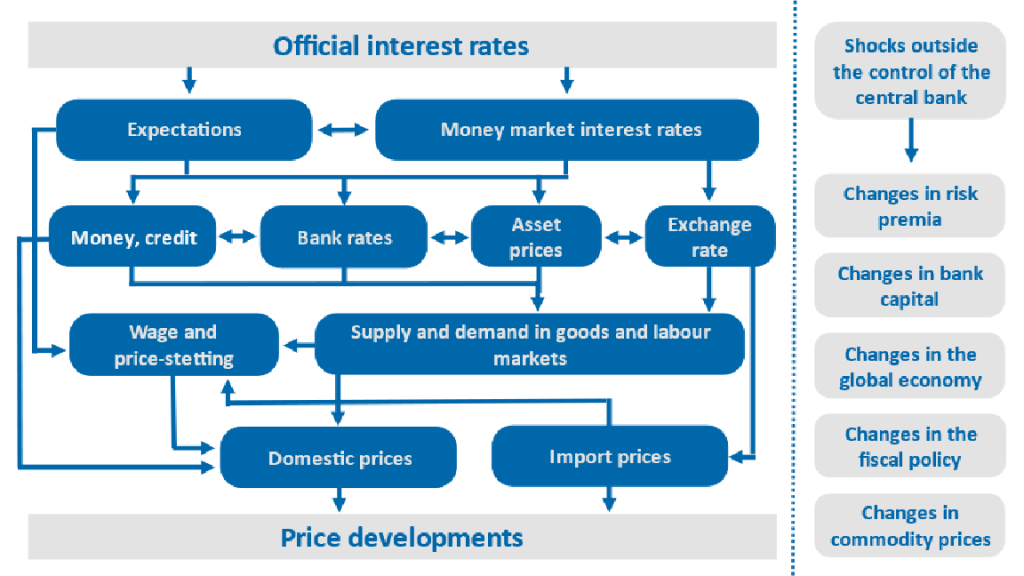

The central bank’s monetary policy affects the economy through monetary policy instruments, which influence the economy through various channels such as the interest rate channel, the credit channel, the exchange rate channel, and the wealth channel. This process by which are the taken decisions translated into the economy is called the monetary policy transmission mechanism.

The Eurosystem, in the Slovak Republic represented by the National Bank of Slovakia, is the monopoly supplier of monetary base, which consists of currency in circulation and bank reserves. This allows the central bank to set the conditions under which banks can borrow money from it. This way, the central bank also affects the conditions under which the banks make transactions between themselves and conditions (particularly interest rates) under which commercial banks lend money to businesses and households. Changes in the conditions for lending money change the behaviour of businesses and households and determine the development of prices and production of goods and services.