-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary Policy Briefs

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

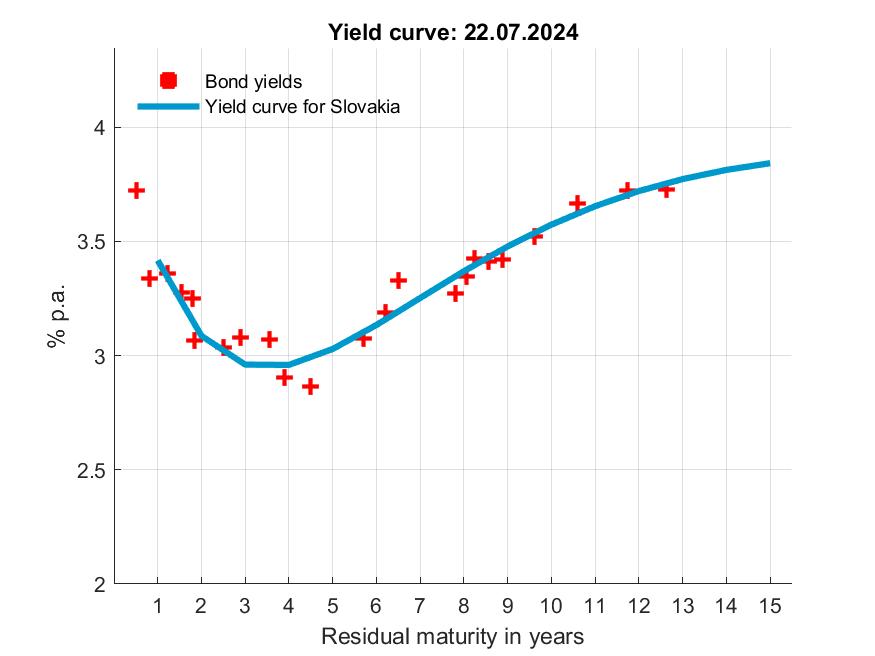

Estimated yield curve

Zero-coupon yield curve is estimated from the sovereign securities issued by Slovak republic using Nelson-Siegel-Svensson (NSS) method. Estimated zero-coupon yield curve reflects interest rates expectations over the maturity spectrum of Slovak sovereign securities market. Estimated notional yields are values adjusted for different coupons and other cash-flow conditions attached to individual security issues and estimated by using the NSS functional form.

There are two innovations compared to the methodology outlined in the manual MFSR1, First, only sovereign bonds with maturity between 6 months and 15 years enter the calculation and second, historical starting values are being used rather than those of the Bundesbank zero-coupon yield curve estimate.

Due to the change in methodology, time series before 2017 may not be fully consistent with the estimate after 1st January 2017. National Bank of Slovakia shall not be held liable for accuracy of these historical estimates.

Spot yield curve | Implied forward curve

YC_Data

505.46 kB

Disclaimer and limitation of liability

The content of this website section is made available by the National Bank of Slovakia for public information purposes only. It is not intended to be used for calculating price/yield quotations, identifying trading opportunities or as the basis for any other form of advice regarding the pricing of financial assets or identifying investment opportunities.

The National Bank of Slovakia aims to keep the content of this website section current and accurate, taking reasonable measures to update this site every Monday. An update may however be occasionally delayed due to public holidays.

The National Bank of Slovakia acknowledges some persistent inaccuracies in the estimated values, which originate from lower liquidity of the sovereign bond market in Slovakia, limited number of traded securities, which induces limited price observations that enter the calculation. Inaccuracies due to the above factors can accumulate up to 30 basis points on average. Values corresponding to the short end of the yield curve (maturity of less than 2 years) may be subject to higher than estimated errors. (please read further about testing inaccuracies of the market in the Analytical note from 6th of june 2017).

The National Bank of Slovakia shall not be liable for any error or inaccuracy in the content of this section, for any delay in updating this section, for any reference made to the published values in contractual agreements, investment decisions or the outcomes of any investments made by users of this website section.

1) The explanatory note: Ódor, L., Povala P. (2015): Estimates of the Slovak zero-coupon yield curve. IFP maunual is published here. Yield curve estimates from the period prior to 2017 using former methodology are also available on the website of the Ministry of Finance.

Last updated on 23 Jul 2024