-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Carbon Footprint Report of NBS Climate-related disclosures of NBS non-monetary policy portfolios Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary

- Policy Briefs Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

Management Companies

A management company is a company that:

• does business in the field of collective investment;

• does business within the scope of an authorisation granted by Národná banka Slovenska;

• is authorised to establish and manage collective investment undertakings;

• has the legal form of a joint-stock company;

• has its registered office in Slovakia;

• has in its business name the designation správcovská spoločnosť, akciová spoločnosť or správ. spol., a. s.

-

What is collective investment?

A collective investment is:

• a business activity

• in which capital is raised from investors

• with the aim of joint investment

• with a defined investment policy

• for the benefit of the investors,

• in which the investors are exposed to market risk.Raising capital for the purpose of its subsequent investment is prohibited if:

• the return on the capital raised from investors is even partially dependent on the value of or return on assets acquired using the raised capital, and at the same time;

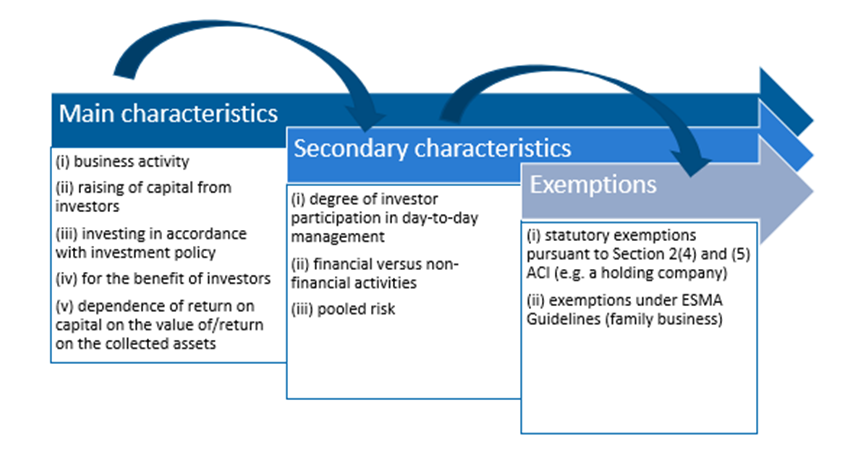

• it is performed without authorisation or not performed pursuant to the conditions established by the Act on Collective Investment.In order to evaluate whether a planned or ongoing activity is or is not collective investment, it is necessary to assess:

• whether all the main characteristics of the definition of collective investment are met, also taking into account secondary (auxiliary) characteristics; and

• whether the assessed activity does not fall under any exemption established by the Act on Collective Investment (ACI) or the ESMA Guidelines.

-

What types of authorisations may be granted to a management company?

The main activity of a management company is the establishment and management of funds based on an authorisation granted by Národná banka Slovenska (NBS).

NBS can grant two types of authorisations to a management company:

(i) authorisation to establish and manage standard funds and European standard funds (UCITS funds) (authorisation under Section 28 of the Act on Collective Investment); or

(ii) authorisation to establish and manage alternative investment funds and foreign alternative investment funds (AIFs) (authorisation under Section 28a of the Act on Collective Investment).Management companies may perform only those activities they are authorised to perform under the Act on Collective Investment.

-

What other activities may a management company perform?

A management company may provide other services provided that they are expressly specified in the authorisation granted under the Act on Collective Investment and do not require separate authorisation under the Act on Securities and Investment Services, as follows:

(i) if explicitly stated in the authorisation, the following activities are permitted:

• portfolio management of financial instruments or investment management for funds created under the Act on the Supplementary Pension Scheme (‘portfolio management’);

(ii) if explicitly stated in the authorisation that includes the authorisation of portfolio management services, the following activities are permitted:

• investment advice;

• safekeeping and administration of selected securities, including custodianship and related services, such as cash/collateral management;

(iii) if explicitly stated in the authorisation under Section 28a of the Act on Collective Investment that includes the authorisation of portfolio management services, the following activity is permitted:

• reception and transmission of orders in relation to one or more financial instruments.

-

Authorisation for the establishment and management of UCITS funds

A management company can apply to Národná banka Slovenska for an authorisation to establish and manage UCITS funds. Such authorisation under Section 28 of the Act on Collective Investment covers the establishment and management of:

• standard funds, and

• European standard funds.Standard funds are:

• funds that meet the conditions of the UCITS Directive for investing in transferable instruments and risk-spreading, and at the same time are

• established in Slovakia on the basis of an NBS authorisation.European standard funds are:

• funds that meet the conditions of the UCITS Directive for investing in transferable instruments and risk-spreading, and at the same time are

• established on the basis of an authorisation from another EU Member State.

-

Authorisation for the establishment and management of alternative investment funds (AIFs)

A management company can apply to Národná banka Slovenska for an authorisation to establish and manage AIFs. Such authorisation under Section 28a of the Act on Collective Investment covers the establishment and management of:

• alternative investment funds, and

• foreign alternative investment funds.Alternative investment funds are:

• funds that do not meet the conditions of the UCITS Directive;

• are regulated under the AIFMD legislation;

• as a rule, established in Slovakia on the basis of an NBS authorisation.Foreign alternative investment funds are:

• funds that do not meet the conditions of the UCITS Directive;

• are regulated under the AIFMD legislation;

• as a rule, established on the basis of an authorisation from another EU Member State (European foreign AIF) or from another state (non-European foreign AIF).Management companies authorised pursuant to Section 28a of the Act on Collective Investment are also required to comply with the reporting obligations pursuant to NBS Decree No 1/2015 for the purposes of supervision and systemic risk monitoring.

Legislation

ESMA Questions and Answers

List of Memoranda of Understanding under the AIFMD

Further information regarding collective investment can be found on the websites of the European Commission and ESMA.