-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Carbon Footprint Report of NBS Climate-related disclosures of NBS non-monetary policy portfolios Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary

- Policy Briefs Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

Funds (collective investment undertakings)

In the context of investment, the word ‘fund’ is used in common language with two different meanings:

- sometimes it refers to any of various collective investment undertakings, regardless of their legal form;

- at other times, it refers only to common funds.

Additionally, in English, the term ‘funds’ can sometimes mean cash or money.

-

What are collective investment undertakings?

Collective investment undertakings can be referred to for convenience as funds. They are entities through which collective investment is carried out.

Funds can be categorised according to various criteria:

• according to their place of establishment;

• according to their legal form;

• according to their investment policy;

• according to the rights of investors (shareholders/unit-holders);

• according to the permitted category of investors.

-

How are funds categorised according to their place of establishment?

Funds are categorised according to their place of establishment into:

• domestic, and

• foreign.Domestic funds are established in the territory of Slovakia in accordance with the Act on Collective Investment. They are supervised by Národná banka Slovenska. Domestic funds must have a depositary. The depositary ensures the depositary safekeeping of the fund’s assets and checks whether the management company handles the fund’s assets in accordance with the Act on Collective Investment.

Foreign funds:

• they are foreign collective investment undertakings;

• they may be legal entities or have no legal personality;

• they are established and managed by a (foreign) management company or are self-managed;

• they are established and managed in accordance with the law of the country in which the fund was established or in which it has its registered office.

-

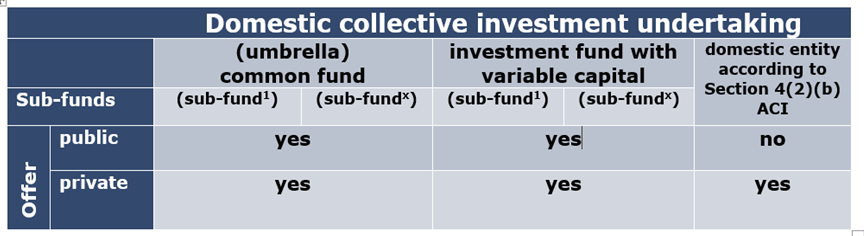

• How are domestic funds categorised according to their legal form?

Domestic funds are categorised according to their legal form as follows:

a. common funds;

b. investment funds with variable capital established in the territory of Slovakia in the form of a joint-stock company with variable capital;

c. other domestic entities with legal personality established in the territory of the Slovakia in the form of a company or cooperative which raises capital from several investors with the aim of investing it in accordance with a defined investment policy for the benefit of these investors (these entities are often referred to as collective investment undertakings under Section 4(2)(b) of the Act on Collective Investment).

-

What are common funds?

- is one of many types of collective investment undertakings;

- is established by a management company;

- is not a legal entity;

- represents the joint property of unit-holders (shareholders), and that joint property is managed by a management company, which invests it for the benefit of unit-holders (shareholders) in accordance with the fund´s statute;

- the equity rights of unit-holder (shareholders) are represented by unit certificates (share certificates);

- may consist of two or more sub-funds (such a mutual fund is hereafter referred to as an ‘umbrella common fund’).

-

What are sub-funds?

A sub-fund is:

• part of an umbrella common fund’s assets and liabilities that is separated pursuant to accounting rules; or

• part of the assets and liabilities of an investment fund with variable capital that is separated pursuant to accounting rules.Each sub-fund must be distinguished from other sub-funds of the same umbrella fund by one or more features determined by the statute of the umbrella common fund or by the articles of association of the investment fund with variable capital.

-

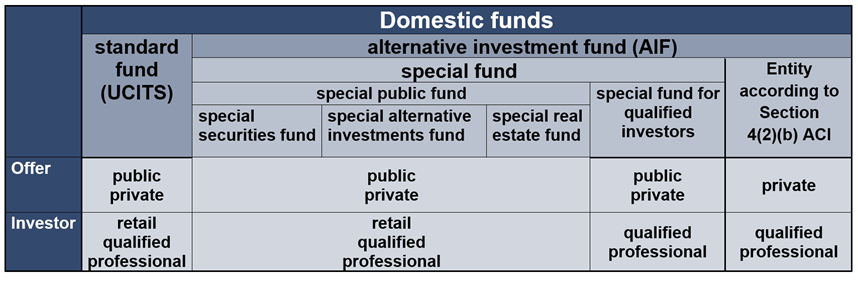

How are domestic funds categorised according to their investment policy ?

Standard and alternative investment funds can be categorised according to their investment policy.

A standard fund:

• is a common fund or investment fund with variable capital;

• is a fund that meets the conditions of the UCITS Directive for investing in transferable securities and for risk-spreading;

• is established in Slovakia on the basis of an authorisation from Národná banka Slovenska;

• can be offered to retail investors through a public or a private offer.A special fund:

• is a common fund or investment fund with variable capital;

• does not meet the conditions of the UCITS Directive for investing in transferable securities and for risk-spreading;

• is regulated under the EU’s AIFMD legislation;

• in the form of a public special fund in Slovakia is established on the basis of an authorisation from Národná banka Slovenska;

• in the form of a public special fund can be offered to retail investors through a public or a private offer;

• in the form of a special fund for qualified investors is established either by registration in the register of supervised entities of Národná banka Slovenska or by authorisation;

• in the form of a special fund for qualified investors can only be offered to professional or qualified investors.An entity under Section 4(2)(b) of the Act on Collective Investment:

• is established in the form of a company or a cooperative which has its registered office in the territory of Slovakia and which raises capital from several investors with the aim of investing it in accordance with a defined investment policy for the benefit of these investors;

• does not meet the conditions of the UCITS Directive for investing in transferable securities and for risk-spreading;

• is regulated under the EU’s AIFMD legislation;

• does not require authorisation if it meets the exception criteria in Section 31a(1) of the Act on Collective Investment;

• can only be offered to professional or qualified investors as defined in Section 31d of the Act on Collective Investment, exclusively by means of a private offer.

-

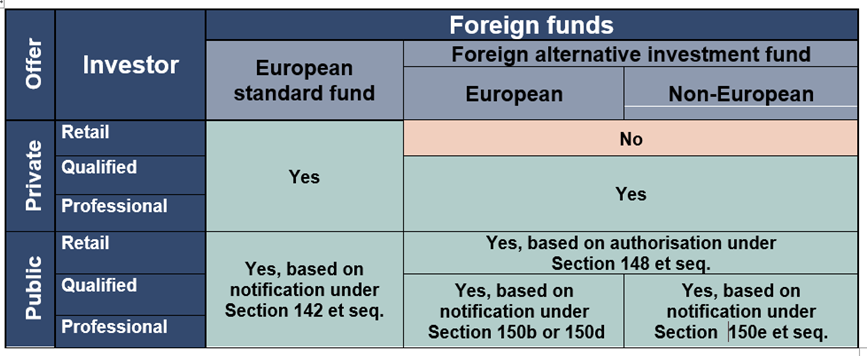

Can foreign funds be offered to investors in Slovakia?

Yes, foreign funds can also be offered in Slovakia on the basis of either a notification or an authorisation from Národná banka Slovenska. Whether the fund is offered under the notification or authorisation regime depends on:

• the category of the foreign fund concerned;

• the range of investors to whom it is offered;

• whether the offer is public or private;

• whether it is offered by a management company, a foreign European or a non-European management company.

Note: The table contains references to provisions of the Act on Collective Investment.

European standard funds:

• meet the conditions of the UCITS Directive for investing in transferable securities and for risk-spreading;

• are established under an authorisation granted in another EU Member State;

• can be offered in the territory of Slovakia in the form of a public offer based on a notification under Section 142 et seq. of the Act on Collective Investment.Foreign alternative investment funds:

• do not meet the conditions of the UCITS Directive;

• are regulated under the EU’s AIFMD legislation;

• are, as a rule, established under an authorisation granted in another EU Member State (European foreign AIF) or in a third country (non-European foreign AIF);

• can be offered in the territory of Slovakia to retail investors only under an authorisation from Národná banka Slovenska in accordance with Section 148 et seq. of the Act on Collective Investment.

-

What other types of funds are permitted under EU regulations?

Under special regulations of the European Union, other types of standard and alternative investment funds can also be established, all of them characterised by a simplified process for their cross-border distribution in the EU:

Standard funds Alternative investment funds Money market funds (MMF) Money market funds (MMF) European Venture Capital Funds (EuVECA) European Social Entrepreneurship Funds (EuSEF) European Long-Term Investment Funds (ELTIF) Regulations of the European Parliament and Council (EU) 2017/1131 on money market funds 345/2013 on European venture capital funds 346/2013 on European social entrepreneurship funds 2015/760 on European long-term investment funds 2023/606 which changes regulation 2015/760 (ELTIF 2.0) Money market funds (MMFs):

• invest in short-term assets (assets with a residual maturity not exceeding two years);

• have separate or cumulative objectives to offer returns in line with money market rates or to preserve the value of the investment;

• can be offered to retail investors as well as professional investors.European Venture Capital Funds (EuVECAs) and European Social Entrepreneurship Funds (EuSEFs):

• are established in an EU Member State;

• aim to invest their assets mainly in what are known as qualifying investments;

• are offered exclusively to investors deemed to be professional clients or qualified investors who commit to invest at least €100,000 and acknowledge in writing that they are aware of the risks associated with the investment.European Long-Term Investment Funds (ELTIFs):

• are established in an EU Member State;

• aim to invest their assets mainly in what are known as eligible investment assets;

• can be offered to retail investors as well as professional investors.

-

How are funds categorised according to investor rights?

Domestic and foreign funds can be categorised according to the rights of investors into open-end funds and closed-end funds.

Domestic funds can be established for: an indefinite or a definite period a definite period Open-end funds Closed-end funds unit-holders have the right to request that their shares are redeemed out of the fund’s assets unit-holders do not have the right to request that their shares are redeemed out of the fund’s assets Open-end fund

• Its unit-holders (shareholders) have the right to have their unit certificates (shares) redeemed out of the fund’s assets at their request.

• A domestic open-end fund can be established for a definite or indefinite period.Closed-end fund

• Its unit-holders (shareholder) do not have the right to have their unit certificates (shares) redeemed out of the fund´s assets at their request.

• A domestic closed-end fund can be established only for a definite period not exceeding ten years.

-

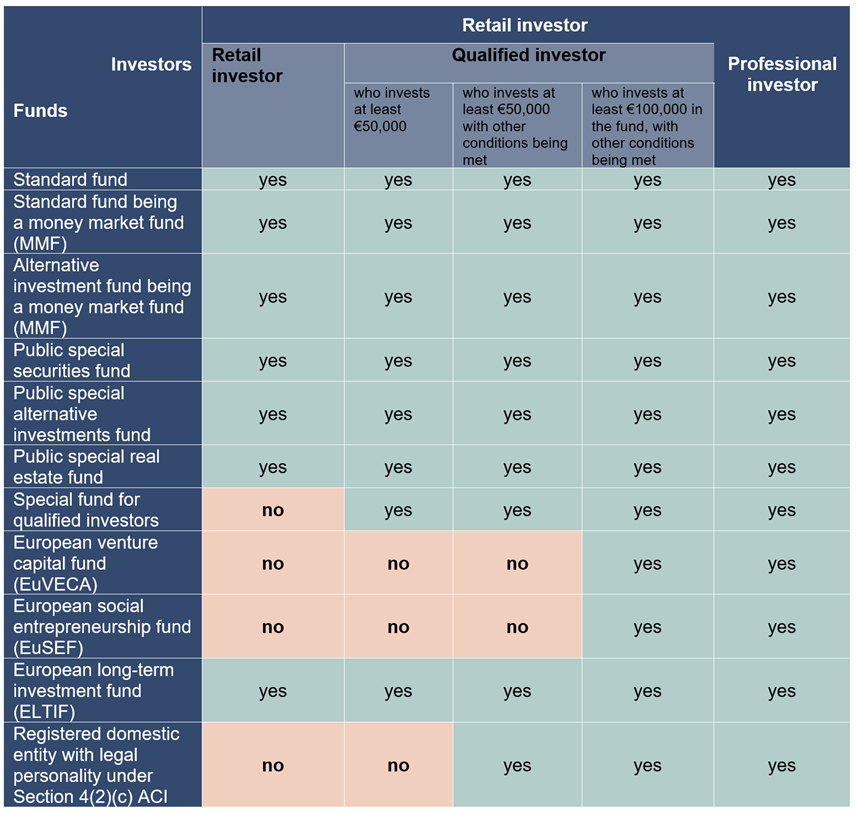

What types of funds can be offered to retail clients?

Some funds can only be offered to a limited circle of experienced investors, such as professional investors or qualified investors. On the other hand, some funds can be offered to a wide range of investors, who are called retail investors.

The following types of funds can be offered to retail investors:

• domestic or European standard funds;

• money market funds, which may be in the form of a standard or an alternative investment fund;

• public special funds (special securities funds, special alternative investment funds, and special real estate funds);

• European long-term investment funds (ELTIFs).

-

What types of funds can be offered only to professional or qualified clients

Some funds can only be offered to a limited circle of experienced investors, such as professional investors or qualified investors. All types of funds can be offered to professional investors.

Qualified investors can be offered all the funds that can be offered to retail investors, plus the following types of funds, after meeting various strict conditions:

• special funds for qualified investors (investment of at least €50,000);

• European Venture Capital Funds (EuVECAs) and European Social Entrepreneurship Funds (EuSEFs) (investment of at least €100,000 and written acknowledgement from the investor that he or she is aware of the risks associated with investing);

• collective investment undertaking under Section 4(2)(b) of the Act on Collective Investment (offered exclusively in the form of a private offer; investment of at least €50,000; fulfilment of other conditions under Section 31d of the Act on Collective Investment).

Legislation

ESMA Questions and Answers

List of Memoranda of Understanding under the AIFMD

Further information regarding collective investment can be found on the websites of the European Commission and ESMA.