RRE Dashboard

The dashboard includes a set of indices used by the National Bank of Slovakia to follow and assess the development on the residential real estate market. This market is very important in case of Slovakia, both from the perspective of macroeconomy and financial stability. Home ownership is very high and housing loans form a large part of the banks’ assets. The list includes composite indices, housing affordability indices and macroeconomic models estimating fundamental prices or studying the impact of different shocks on real estate prices. A methodological note in the form of NBS occasional paper is published together with the list of indices, including the methodology, a short economic interpretation and data used for the indices. The list of indices is regularly revised and thus can be adjusted in the future.

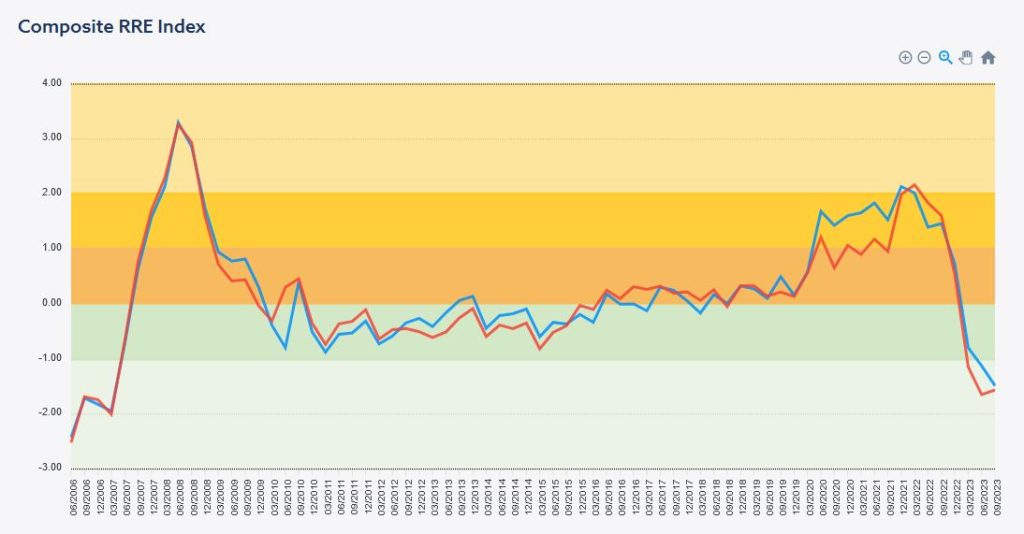

Composite index

The composite index edged up slightly in the second quarter of 2025, yet it continues to hover around its equilibrium level. Upward pressure on the index is driven by robust mortgage demand and rising real estate prices, which are outpacing both inflation and household disposable income. In contrast, housing construction indicators point to potential risks of further price acceleration.

2025Q2

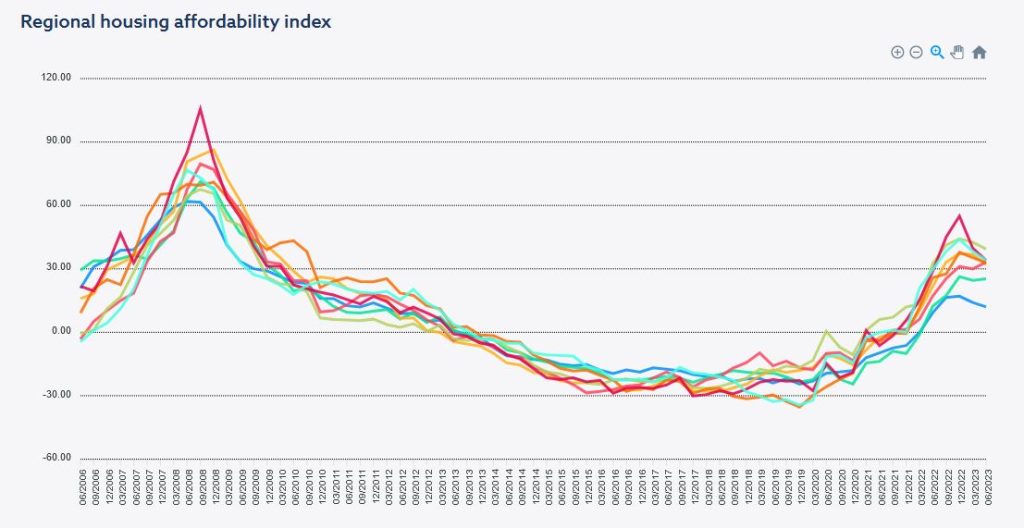

Regional housing affordability index

Housing affordability has improved slightly despite rising property prices. This was supported primarily by unexpectedly strong wage growth and, to a lesser extent, by declining mortgage rates. However, in regions with the fastest price growth — Prešov, Nitra, and Banská Bystrica — wage increases were insufficient, resulting in a deterioration of housing affordability.

2025Q2

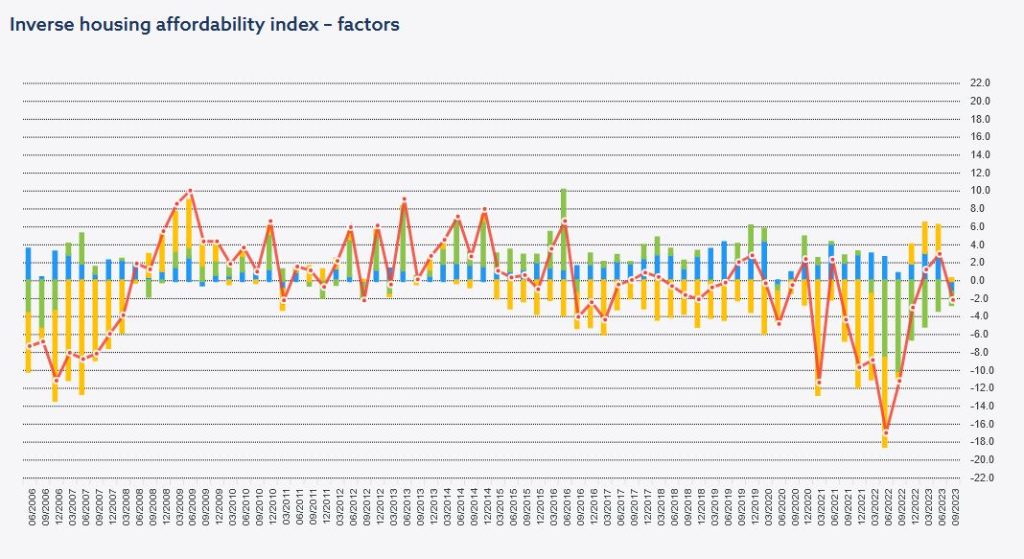

Decomposition of inverse housing affordability index

Housing affordability continued to grow moderately by the end of the 2nd Quarter 2025, but it is still at deteriorated levels.

2025Q2

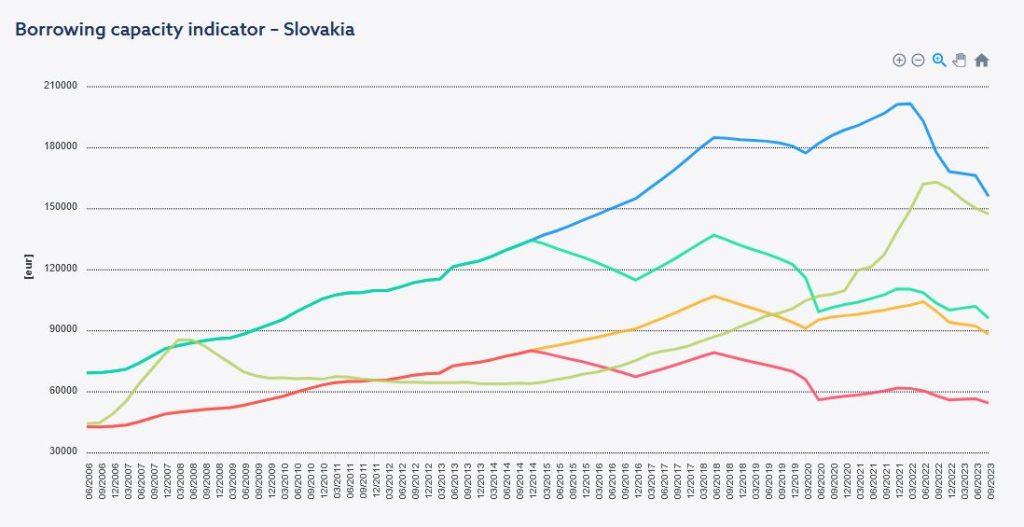

Borrowing capacity indicator

Housing affordability improved across all regions in the second quarter of 2025. This was mainly driven by declining interest rates and rising wages. The most significant improvement occurred in regions with the slowest growth in property prices or the fastest wage growth (Trnava, Žilina, Košice).

2025Q2

Last updated on 4 Nov 2025