RRE Dashboard

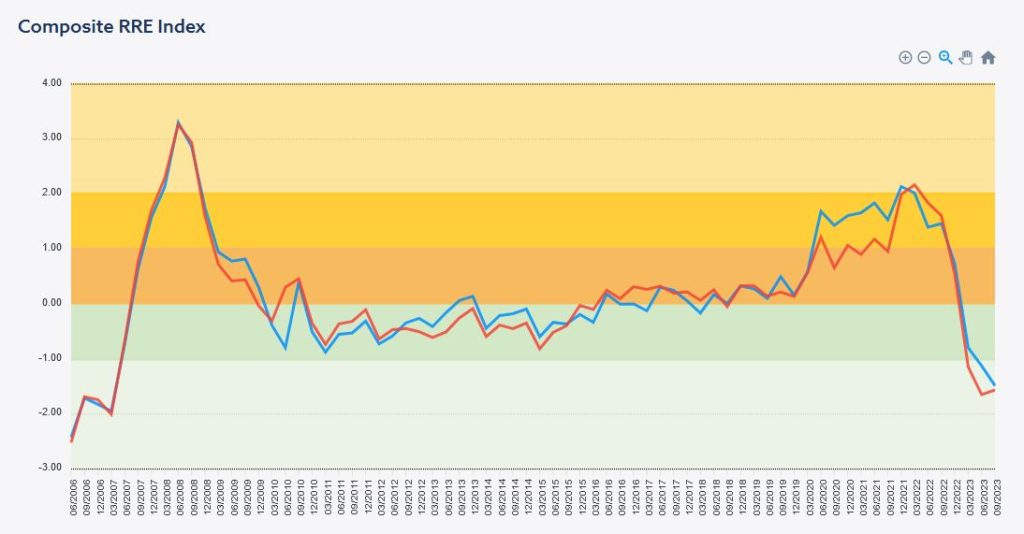

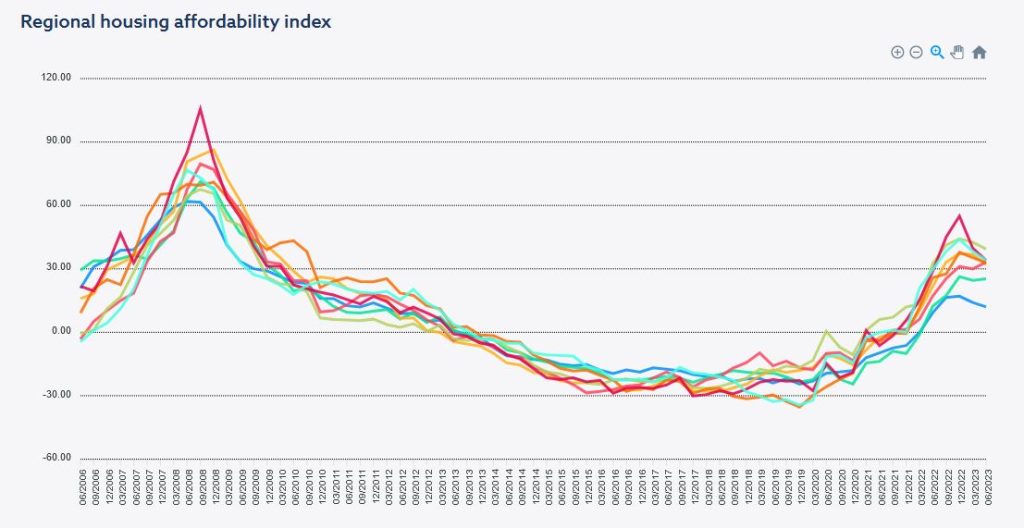

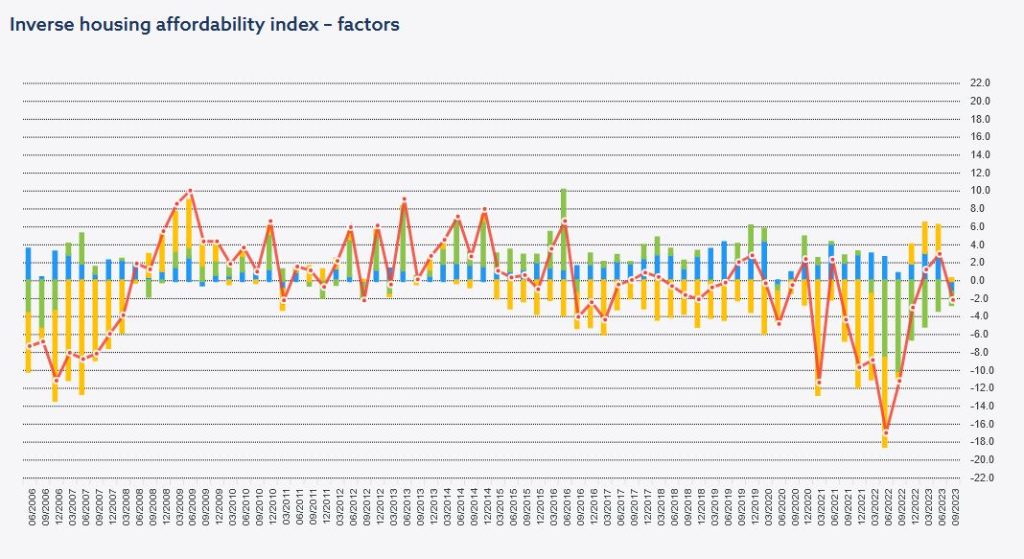

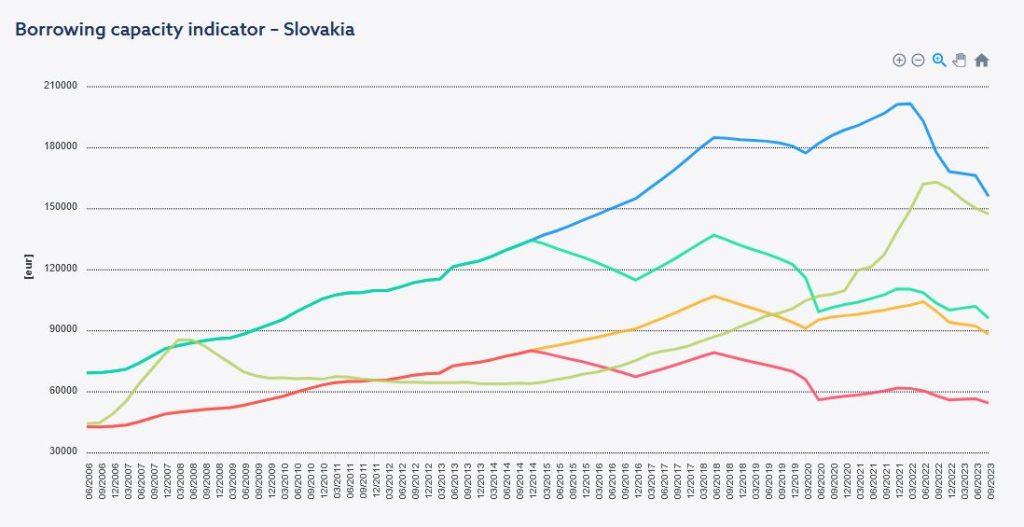

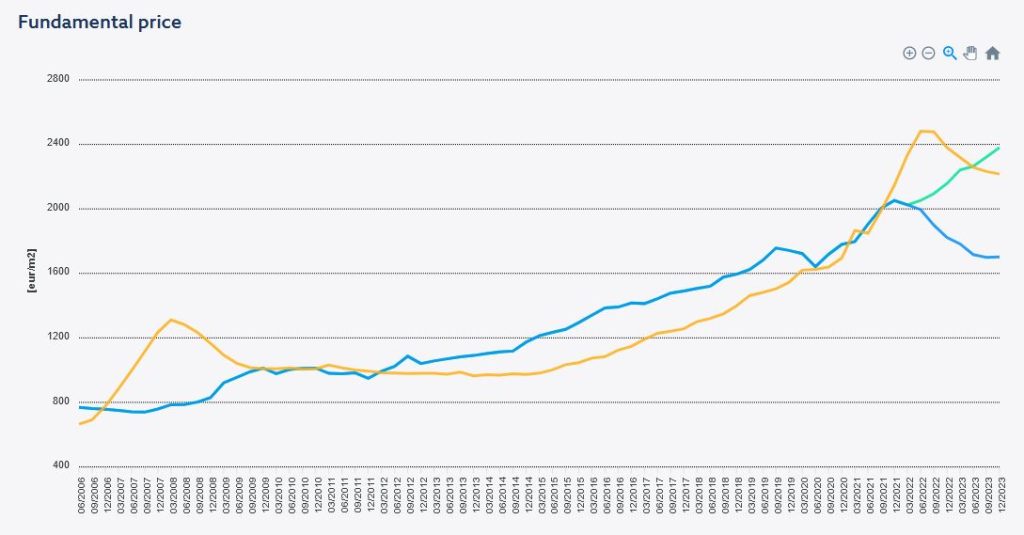

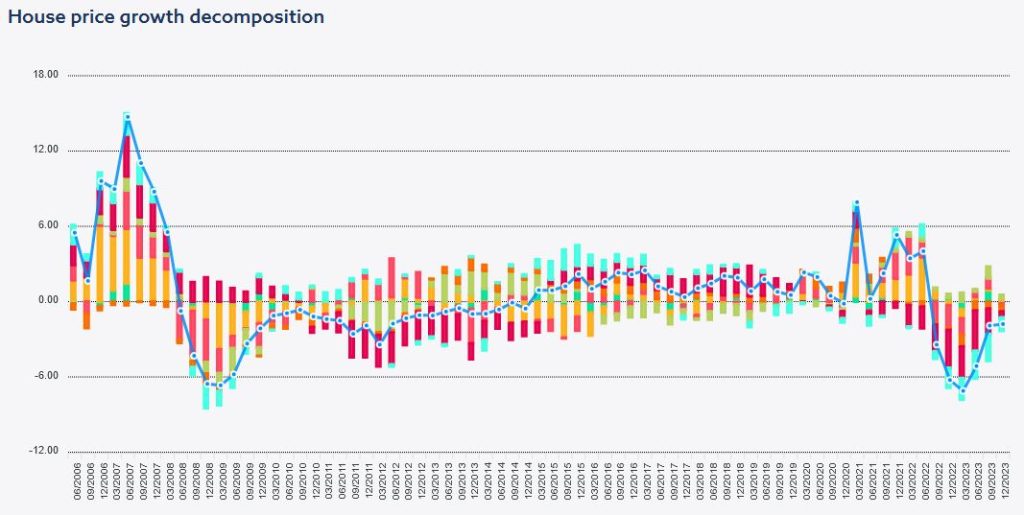

The dashboard includes a set of indices used by the National Bank of Slovakia to follow and assess the development on the residential real estate market. This market is very important in case of Slovakia, both from the perspective of macroeconomy and financial stability. Home ownership is very high and housing loans form a large part of the banks’ assets. The list includes composite indices, housing affordability indices and macroeconomic models estimating fundamental prices or studying the impact of different shocks on real estate prices. A methodological note in the form of NBS occasional paper is published together with the list of indices, including the methodology, a short economic interpretation and data used for the indices. The list of indices is regularly revised and thus can be adjusted in the future.

Last updated on 15 Jul 2024