-

NBS Tasks

Browse topics

- Monetary policy

- Financial market supervision

- Financial stability

- Banknotes and coins

- Payments

- Statistics

- Research

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Carbon Footprint Report of NBS Climate-related disclosures of NBS non-monetary policy portfolios Economic and Monetary Developments Financial Stability Report Investment Policy Statement of the National Bank of Slovakia Macroprudential Commentary

- Policy Briefs Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Structural Challenges Other publications Sign up for your email notifications about publications

- About the Bank

- Media

- Frequently asked questions

-

For the public

Browse topics

- About the Bank

- Exchange rates and interest rates

- Banknotes and coins

- Payments

- Financial stability

- Financial market supervision

- Statistics

- Legislation

-

Publications

- Activity Report of the NBS Innovation Hub Annual Report Economic and Monetary Developments Financial Stability Report Macroprudential Commentary

- Report on the Activities of the Financial Market Supervision Unit Research Papers: Working and Occasional Papers (WP/OP) Statistical Bulletin Other publications Sign up for your email notifications about publications

- Frequently asked questions

- Media

- Careers

- Contact

Sustainable finance and ESG

The European Green Deal sets the goal of the European Union (EU) to make Europe the first climate-neutral continent. This can be achieved through the transition to a greener and more sustainable economy. To support this transition, the EU has adopted several regulations that prescribe obligations for financial institutions as well as non-financial corporations. Key regulations include the Taxonomy Regulation, which defines environmentally sustainable economic activities, the Corporate Sustainability Reporting Directive (CSRD), and the European Green Bond Regulation, which enables the financing of projects in accordance with the EU taxonomy through the issuance of European green bonds.

-

European taxonomy

The EU taxonomy is a classification system that helps companies and investors identify ‘environmentally sustainable’ economic activities to make sustainable investment decisions. Environmentally sustainable economic activities are described as those which ‘make a substantial contribution to at least one of the EU’s six climate and environmental objectives, while at the same time not significantly harming any of these objectives and meeting minimum safeguards’.

-

Are companies obliged to align their activities with the EU taxonomy?

No, they are not.

The EU Taxonomy Regulation (TR) creates a legal framework by defining the conditions that an economic activity must meet in order to qualify as environmentally sustainable. However, this regulation does not impose an obligation on companies to align their economic activities with the EU taxonomy. Through the Disclosures Delegated Act, the TR obliges companies to publish information on whether their individual economic activities fall under the EU taxonomy (i.e. whether they are ‘taxonomy-eligible economic activities’) and, if so, whether they are aligned with EU taxonomy requirements (‘taxonomy–aligned economic activities’).

The EU taxonomy does not set mandatory requirements for environmental behaviour for companies or for financial products. Companies can freely decide whether to align their activities with the EU taxonomy. Investors are also free to decide whether to invest in companies that are or are not aligned with the EU taxonomy.

-

What are the characteristics of an environmentally sustainable activity in accordance with the EU taxonomy?

The EU Taxonomy Regulation (TR) creates a legal framework by defining four overarching conditions that an economic activity must meet in order to qualify as environmentally sustainable:

- Making a substantial contribution to at least one of the EU’s six environmental objectives (‘substantial contribution’ or ‘SC’);

- Doing no significant harm to any of the EU’s other five environmental objectives (‘do no significant harm’ or ‘DNSH’);

- in the field of human and social rights (‘minimum safeguards’ or ‘MS’); and

- Complying with the technical screening criteria stated in the Taxonomy Delegated Acts (‘technical screening criteria’ or ‘TSC’).

-

How are the objectives defined in the EU taxonomy?

The EU taxonomy enumerates six EU objectives:

- climate change mitigation;

- climate change adaptation;

- sustainable use and protection of water and marine resources;

- transition to a circular economy;

- pollution prevention and control;

- protection and restoration of biodiversity and ecosystems.

The first two objectives are known as the climate objectives (climate change mitigation and climate change adaptation). The remaining objectives are known as the environmental objectives.

-

What is meant by minimum safeguards in the EU taxonomy?

To qualify as environmentally sustainable, an economic activity has to be carried out in compliance with minimum safeguards in the field of human and social rights. The EU taxonomy encourages companies to implement procedures to ensure the alignment of their activities with minimum requirements under the following international conventions and documents:

- the OECD Guidelines for Multinational Enterprises;

- the UN Guiding Principles on Business and Human Rights;

- the Declaration of the International Labour Organisation on Fundamental Principles and Rights at Work; and

- the International Bill of Human Rights.

-

Which EU legal acts lay down detailed requirements for environmentally sustainable activities?

Environmentally sustainable economic activities are regulated through two Commission Delegated Regulations:

- the Climate Delegated Regulation – a Commission Delegated Regulation defining environmentally sustainable economic activities for the first two climate objectives

- the Environmental Delegated Regulation – a Commission Delegated Regulation defining environmentally sustainable economic activities for the remaining four environmental objectives.

These legal acts cover sectors that have the greatest impact on the climate, such as energy, construction, and the chemical and steel industries. However, many sectors or activities have not yet been defined (e.g. the food industry, agriculture). If some economic activity is not listed in the EU taxonomy, it does not automatically mean that it represents a ‘brown’ or harmful activity.

-

Where can I find out whether a company’s activities are EU taxonomy-aligned?

Under the EU taxonomy, companies are required to publish information annually in their annual or sustainability reports on whether their individual economic activities fall under the EU taxonomy (i.e. whether they are ‘EU taxonomy-eligible economic activities’) and, if so, whether they are aligned with EU taxonomy requirements (‘taxonomy-aligned economic activities’).

However, not all companies are obliged to publish information under the Disclosures Delegated Act. This obligation applies only to companies obliged to publish non-financial information under Article 19a or Article 29a of Directive 2013/34/EU. Such companies or parent undertakings are obliged to include in their annual or consolidated annual or sustainability reports information on how and to what extent their activities are related to economic activities that are described as environmentally sustainable.

Companies subject to this disclosure obligation are required to publish various key performance indicators (KPIs) related to turnover, capital expenditure (CapEx) and operating expenditure (OpEx). For the purposes of the transition to a low-carbon, more ecological and sustainable economy, it will be important to monitor in the future the share of capital expenditure (CapEx) intended for alignment with the EU taxonomy.

-

Where can I find out more about the EU taxonomy?

Further information regarding the EU taxonomy can be found on the website of the European Commission or on the EU Taxonomy Navigator dedicated website—a practical guide that includes frequently asked questions.

On 8 November 2024, the European Commission published a Commission Notice on the interpretation and implementation of certain legal provisions of the Disclosures Delegated Act under Article 8 of the EU Taxonomy Regulation on the reporting of eligible economic activities and assets (Third Commission Notice) C/2024/6691. This interpretative notice is addressed to financial institutions and supplements previous notices (Commission Notice C/2023/305 and Commission Notice 2022/C 385/01) and frequently asked questions published by the European Commission (FAQ 2021 and FAQ 2022).

-

Are companies obliged to align their activities with the EU taxonomy?

-

Corporate sustainability reporting (CSRD)

EU law requires all large companies and all listed companies (except listed micro-enterprises) to disclose information on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment. Corporate sustainability reporting is governed by the Corporate Sustainability Reporting Directive (CSRD), which mandates that this information be reported in a standardised manner according to European Sustainability Reporting Standards (ESRS).

-

What are European Sustainability Reporting Standards?

The CSRD is associated with the expectation that data reported by different companies will be comparable on the basis of being reported in a standardised manner according to the European Sustainability Reporting Standards (ESRS). The first set of ESRS adopted by the ESRS Delegated Regulation applies from 1 January 2024 for financial years starting on or after 1 January 2024. These ESRS apply to companies from all sectors.

Group Designation Area Regime Cross-cutting ESRS 1 General requirements Mandatory Cross-cutting ESRS 2 General disclosures Mandatory Environmental ESRS E1 Climate change Subject to double materiality principle Environmental ESRS E2 Pollution Subject to double materiality principle Environmental ESRS E3 Water and marine resources Subject to double materiality principle Environmental ESRS E4 Biodiversity and ecosystems Subject to double materiality principle Environmental ESRS E5 Resource use and circular economy Subject to double materiality principle Social ESRS S1 Own workforce Mandatory Social ESRS S2 Workers in the value chain Subject to double materiality principle Social ESRS S3 Affected communities Subject to double materiality principle Social ESRS S4 Consumers and end-users Subject to double materiality principle Governance ESRS G1 Business conduct Subject to double materiality principle The reported data will need to be digitally marked to be machine-readable and available through the European single access point (ESAP).

Originally, there were plans to issue also ESRS designed for:

- listed SMEs;

- companies from specific sectors (sectoral ESRS);

- non-European companies;

- unlisted SMEs on a voluntary basis.

The Commission published voluntary sustainability reporting standards for SMEs (VSME) in the form of a recommendation. The VSME itself can be found in Annex I and the VSME guidelines can be found in Annex II. The Commission recommends that non-listed SMEs and micro-undertakings that wish to voluntarily report sustainability information do so in accordance with the VSME. The Commission recommends that undertakings subject to the requirements to mandatorily report under CSRD, where they need sustainability information from SMEs in their value chains for the purposes of sustainability reporting, should limit as far as possible their requests for such information to the information provided pursuant to VSME. The Commission recommends that banks, insurance undertakings and other financial market participants, where they need sustainability information from SMEs, should limit as far as possible their requests for such information to the information provided pursuant to VSME.

-

Where can reported sustainability information be found and since when has it been available?

Reported sustainability information according to European Sustainability Reporting Standards (ESRS) can be found in annual or consolidated annual reports. They will be published for the first time in 2025 for the financial year starting on or after 1 January 2024.

In the ESRS Delegated Regulation (Appendix C – List of phased-in Disclosure Requirements), the phased-in disclosure requirements for the relevant data points are listed based on the size of the reporting company.

-

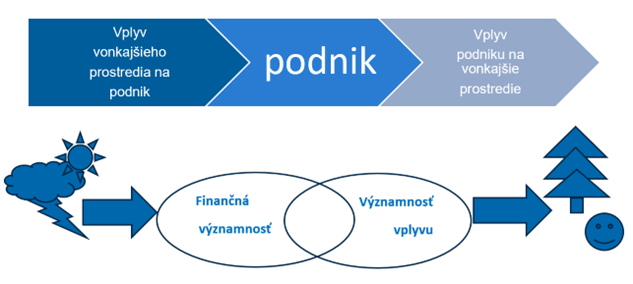

What is the double materiality principle?

Not all European Sustainability Reporting Standards (ESRS) are to be reported by all companies. Only general ESRS 1, ESRS 2 and social ESRS S1 must be disclosed by all relevant companies.

Other ESRS (ESRS E1-5, ESRS S2-4, ESRS G1) are based on the ‘double materiality’ principle. This means that the relevant companies are obliged to disclose them after assessing the double materiality:

- impact materiality (refers to the assessment of whether the company has material actual or potential, positive or negative impacts on people or the environment in the short, medium or long term);

- financial materiality (refers to the assessment of whether there are risks or opportunities that have a material impact, or could reasonably be expected to have a material influence, on the company’s development, financial position, financial performance, cash flows, access to finance or cost of capital over the short, medium or long term).

The ESRS are described as interoperable in relation to other international standards based on the principle of impact materiality (e.g. GRI) or on the principle of financial materiality (e.g. ISSB). As they are based on partly the same principles, ESRS and other international standards are not fully harmonised.

-

Is the reported sustainability information subject to assurance by auditors?

Yes, it is. The CSRD requires companies to report sustainability information according to European Sustainability Reporting Standards (ESRS) and this reporting is subject to limited assurance. The Slovak Accounting Act states that assurance services in the area of corporate sustainability reporting are to be provided by auditors.

-

Does Národna banka Slovenska (NBS) supervise all companies that are subject to corporate sustainability reporting?

No, it does not. NBS supervises those companies whose securities are admitted to trading on a regulated market in the Slovak Republic and the supervised financial institutions.

The European Securities and Markets Authority (ESMA) has issued Guidelines on Enforcement of Sustainability Information (GLESI) for the purpose of supervising the reporting of sustainability information. To support the implementation of these new requirements, supporting materials, a video on GLESI, and a Public Statement on ESRS are available in English on the ESMA website.

-

Where can I find out more about corporate sustainability reporting?

Further information on corporate sustainability reporting can be found on the websites of the following:

-

What are European Sustainability Reporting Standards?

-

Green and sustainable bonds

Various types of green or sustainable bonds, issued with reference to voluntary international market standards, play an important role in financing the activities required for the transition to a low-carbon, greener and more sustainable economy. In its 2018 action plan on financing sustainable growth, the European Commission set out to develop a clear gold standard for green bonds—European green bonds.

-

What types of green, social, and sustainable bonds do we distinguish?

There are various bonds on the market labelled as green, social or sustainable, typically issued with reference to voluntary internationally recognised market standards (such as the ICMA Green Bond Principles or Climate Bonds Initiative principles).

The European Green Bond Regulation distinguishes between the following types of bonds:

- European green bonds (EuGBs);

- bonds marketed as environmentally sustainable (‘use-of-proceeds bonds’ or ‘environmentally sustainable bonds’);

- sustainability-linked bonds.

European green bonds (EuGBs) are a voluntary type of green bond where:

- ecological economic activities are defined with reference to the detailed criteria of the EU taxonomy;

- the issuer publishes transparent information about the use of proceeds for specific environmental goals;

- mandatory reviews are performed by an external reviewer both before and after issuance; and

- the external reviewer is supervised by the European Securities and Markets Authority (ESMA).

Bonds marketed as environmentally sustainable (known as ‘use-of-proceeds bonds’ or ‘environmentally sustainable bonds’) are bonds marketed as green, social or sustainable, the proceeds of which must be used for a specific environmentally sustainable project or socially sustainable project.

Sustainability-linked bonds are bonds that tie the terms of payment or the amount of yield to whether the issuer achieves predefined sustainability goals. Their financial or structural characteristics may therefore differ depending on whether the issuer achieves these targets.

-

Do EU-domiciled issuers have to issue European green bonds?

No, they do not. Since the European Green Bond Regulation is based on an ‘opt-in’ regime, EU issuers can continue to issue ‘ordinary’ green bonds not subject to the European Green Bond Regulation.

Such ordinary green bonds cannot have the ‘European green bond’ designation. They may, however, be issued on the basis of internationally recognised market standards, such as ICMA Green Bond Principles or the Climate Bonds Initiative principles.

National supervisory authorities currently require, based on an ESMA Public Statement, that at least basic information about the nature of the green projects financed by ‘ordinary’ green bonds be published in the bond prospectus.

Issuers of debt securities are required to disclose information in prospectuses pursuant to the Prospectus Regulation, as amended by Regulation 2024/2809, part of a legislative package known as the Listing Act.

-

What are European green bonds?

European green bonds are a voluntary type of green bond where:

- ecological economic activities are defined with reference to the detailed criteria of the EU taxonomy;

- the issuer publishes transparent information about the use of proceeds for specific environmental goals compliant with EU taxonomy-aligned environmental objectives;

- the issue is reviewed by an external reviewer.

External reviewers of European green bonds carry out reviews of such bonds both before and after their issuance. External reviewers are supervised by ESMA and must be registered in ESMA’s register of external reviewers for European green bonds. They are required to review the final allocation of the bond’s proceeds to ensure that the proceeds have actually been used for the predefined environmental goal or project.

For the transparent disclosure of information and monitoring of the use of proceeds, issuers of European green bonds are required to publish on their websites:

- before the bond is issued, the completed European green bond factsheet (template given in Annex I);

- once a year, a European green bond allocation report (template given in Annex II);

- at least one time before the maturity of the European green bond, a European green bond impact report (template given in Annex III).

Applications for the issuance of European green bonds can be made from 21 December 2024, when the European Green Bond Regulation entered into force.

-

What information are issuers of other sustainable and green bonds required to disclose?

National supervisory authorities currently require, based on an ESMA Public Statement, that at least basic information about the nature of the green projects financed by ‘ordinary’ green bonds be published in the bond prospectus.

The Commission published communication with guidelines establishing templates for voluntary pre-issuance disclosures for issuers of bonds marketed as environmentally sustainable and sustainability-linked bonds. The Commission published the templates for periodic post-issuance disclosures which may be voluntarily disclosed by issuers of bonds marketed as environmentally sustainable and sustainability-linked bonds.

Issuers of debt securities are required to disclose information in prospectuses pursuant to the Prospectus Regulation, as amended by Regulation 2024/2809, part of a legislative package known as the Listing Act.

-

Where can I find out more about green or sustainable bonds?

Further information on green and sustainable bonds can be found on the European Commission’s website and on ESMA’s dedicated webpage for external reviewers of European green bonds.

-

Where can I find out more about issuers’ obligations?

Further information on issuers’ obligations can be found on the following NBS website page: Issuers of securities – Basic information.

-

What types of green, social, and sustainable bonds do we distinguish?

-

ESG ratings

ESG ratings represent a subjective evaluation of environmental, social and governance (ESG) factors. They provide information on the sustainability performance of a company or financial instrument by assessing its exposure to sustainability risks and/or its impact on people and the environment.

-

What are ESG ratings?

ESG ratings represent a subjective evaluation of environmental, social and governance (ESG) factors and are mainly developed and distributed by various ESG rating providers. These ratings may be referred to by different terms, such as ESG rating, ESG score, ESG evaluation, or ESG assessment. They provide information on the sustainability performance of a company or financial instrument by assessing its exposure to sustainability risks and/or impact on people and the environment.

-

What different types of ESG ratings are there in the market?

There are different types of ESG ratings, which vary according to their underlying methodology:

- aggregate ratings of E, S and G factors, ratings of individual factors (e.g. environmental) or ratings of sub-factors (e.g. climate risks);

- ratings using a double materiality perspective (combining financial materiality and impact materiality) or a single materiality perspective (evaluating only financial risks or only impacts), or ratings using international frameworks/standards (e.g. SDGs);

- ratings adjusted according to the type of economic activity (‘industry-adjusted’) or ratings not adjusted according to the type of economic activity (‘industry-unadjusted’);

- ratings involving the judgement of rating analysts or relying solely on data analysis.

Since ESG rating methodologies can vary significantly across providers, it is necessary to carefully check the methodologies before comparing the ratings of one company by different providers. Comparing incompatible methodologies may lead to inaccurate conclusions.

-

Are ESG ratings regulated or harmonised?

No, ESG ratings are not harmonised. Each ESG provider determines its own methodology.

The European Union has agreed a new regulation on ESG rating providers which will ensure that investors and other stakeholders have access to reliable and comparable information about ESG rating objectives (what is being rated) and methodologies (how the ratings are determined). Considering the importance of ESG ratings in investment decisions, the new regulation is expected to enhance transparency, reduce the risk of greenwashing, and support sustainable investments. ESG rating providers are to be supervised by the European Securities and Markets Authority (ESMA).

-

Where can I find out more about ESG ratings?

Further information on ESG rating providers can be found on the European Commission’s website.

-

What are ESG ratings?

-

Climate benchmarks (PAB and CTB)

Climate benchmarks enable investors and portfolio managers to take into account the carbon footprint of underlying assets when making investment decisions or creating portfolios. Additionally, other benchmarks (not limited to climate benchmarks) disclose various ESG factors in their benchmark statements and methodologies to enhance investor protection through greater transparency.

-

What are climate benchmarks?

The term ‘benchmark’ means:

- an index by reference to which the amount payable under a financial instrument or a financial contract, or the value of a financial instrument, is determined; or

- an index that is used to measure the performance of an investment fund with the purpose of tracking the return of such index or of defining the asset allocation of a portfolio or of computing the performance fees.

Climate benchmarks enable investors and portfolio managers to take into account the carbon footprint of underlying assets when making investment decisions or creating portfolios. Climate benchmarks are regulated by the EU Climate Transition Benchmarks Regulation, while the minimum requirements for their methodologies are regulated by the Commission Delegated Regulation on minimum standards for EU climate transition benchmarks and EU Paris-aligned benchmarks.

-

What types of climate benchmarks there are?

The EU Climate Transition Benchmarks Regulation establishes two types of EU climate-related benchmarks:

- the EU climate transition benchmark (EU CTB); and

- the EU Paris-aligned benchmark (EU PAB).

Climate benchmarks are regulated by the EU Climate Transition Benchmarks Regulation, while the minimum requirements for their methodologies are regulated by the Commission Delegated Regulation on minimum standards for EU climate transition benchmarks and EU Paris-aligned benchmarks.

-

Do other benchmarks have to disclose how they take ESG factors into account?

Yes, all benchmarks—except currency and interest rate benchmarks—are required to disclose how ESG factors are reflected in their methodology and benchmark statement.

The framework for these disclosures is established by the following two EU legal acts:

-

Is there a benchmark that monitors alignment with the EU taxonomy?

There is currently no regulated benchmark that monitors alignment with the EU taxonomy. However, the Platform on Sustainable Finance has published a call for feedback on a draft report that proposes voluntary benchmarks aligned with the EU taxonomy, known as EU Taxonomy-Aligning Benchmarks, both with and without exclusions (EU TABs and EU TABexs).

-

Where can I find out more about climate benchmarks?

Further information on climate benchmarks can be found on the websites of the European Commission and ESMA.

-

What are climate benchmarks?

-

Sustainability-related disclosure in the financial services sector (SFDR)

The Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants and financial advisers to inform investors:

- about their policies on the integration of sustainability risks in their investment decision‐making process or advice (i.e. how external risks impact the financial market participant or financial product); and

- about how and whether they consider the principal adverse impacts of investment decisions on sustainability factors (i.e. how a financial market participant or a financial product affects the external environment).

The SFDR is designed to allow investors to properly assess how sustainability risks are integrated into the investment decision process. Transparent information helps investors make informed decisions when seeking to invest in companies and projects supporting sustainability objectives.

-

Who is obliged by the SFDR to disclose sustainability-related information?

The SFDR imposes disclosure obligations on financial market participants and financial advisers.

Financial market participants are defined as any of the following:

- alternative investment fund managers (AIFMs), including registered managers, managers of qualifying venture capital funds (EuVECA managers), and managers of qualifying social entrepreneurship funds (EuSEF managers);

- management companies of undertakings for collective investment in transferable securities (UCITS management companies);

- insurance undertakings making available an insurance‐based investment product (IBIP);

- investment firms providing portfolio management;

- credit institutions providing portfolio management;

- institutions for occupational retirement provision (IORPs) and pension product manufacturers;

- pan‐European personal pension product (PEPP) providers.

Financial advisers are defined as any of the following:

- insurance intermediaries and insurance undertakings providing insurance advice with regard to IBIPs;

- credit institutions providing investment advice;

- investment firms providing investment advice;

- financial agents and financial advisers which, regardless of their legal form, employ three or more people and provide insurance advice with regard to IBIPs or investment advice;

- AIFMs providing investment advice;

- UCITS management companies providing investment advice.

-

What entity-level disclosures are required under the SFDR?

Financial market participants (FMPs) are required to make the following entity-level disclosures:

Disclosures under Art. 3 Disclosures under Art. 5 Disclosures under Art. 4 Alternative under Art. 4(1)(a) Alternative under Art. 4(1)(b) What? Policies on the integration of sustainability risks in their investment decision‐making process Information on how their remuneration policies are consistent with the integration of sustainability risks Where they consider principal adverse impacts of investment decisions on sustainability factors – a statement on due diligence policies with respect to those impacts Where they do not consider adverse impacts of investment decisions on sustainability factors – clear reasons for why they do not so, including, where relevant, information as to whether and when they intend to consider them Where? The FMP’s website The FMP’s website The FMP’s website in a separate section titled ‘Sustainability-related disclosures’ The FMP’s website in a separate section titled ‘No consideration of adverse impacts of investment decisions on sustainability factors’ Name Name not prescribed Name not prescribed ‘Statement on principal adverse impacts of investment decisions on sustainability factors’ ‘No consideration of adverse impacts of investment decisions on sustainability factors’ Template Template not prescribed Template not prescribed Template set out in Annex I to the SFDR Delegated Regulation Template not prescribed Financial advisers (FAs) are required to make the following entity-level disclosures:

Disclosures under Art. 3 Disclosures under Art. 5 Disclosures under Art. 4 Alternative under Art. 4(5)(a) Alternative under Art. 4(5)(b) What? Policies on the integration of sustainability risks in their investment advice or insurance advice Information on how their remuneration policies are consistent with the integration of sustainability risks Information as to whether they consider in their investment advice or insurance advice the principal adverse impacts on sustainability factors Information as to why they do not to consider adverse impacts of investment decisions on sustainability factors in their investment advice or insurance advice, and, where relevant, including information as to whether and when they intend to consider such adverse impacts Where? The FA’s website The FA’s website The FA’s website in a separate section titled ‘Sustainability-related disclosures’ The FA’s website in a separate section titled ‘No consideration of adverse impacts of investment advice on sustainability factors’ or ‘No consideration of adverse impacts of insurance advice on sustainability factors’ Name Name not prescribed Name not prescribed ‘Statement on principal adverse impacts of investment advice on sustainability factors’ / ‘Statement on principal adverse impacts of insurance advice on sustainability factors’ ‘No consideration of adverse impacts of investment advice on sustainability factors’ / ‘No consideration of adverse impacts of insurance advice on sustainability factors’ Template Template not prescribed Template not prescribed Template not prescribed. The criteria used may refer to the principal adverse impacts stated in Annex I to the SFDR Delegated Regulation Template not prescribed

-

What financial products does the SFDR cover?

For the purposes of the SFDR, financial products are defined as any of the following:

- portfolios managed in accordance with point (8) of Article 4(1) of the second Markets in Financial Instruments Directive (MiFID II);

- alternative investment funds (AIFs) and UCITS funds;

- insurance‐based investment products (IBIPs);

- pension products and pension schemes;

- pan‐European personal pension products (PEPPs).

-

What product-level disclosures are specified in the SFDR? Which of them are mandatory and which are voluntary?

Under Article 6 of the SFDR, financial market participants are required to include descriptions of the following in pre-contractual disclosures for financial products:

- the manner in which sustainability risks are integrated into their investment decisions; and

- the results of the assessment of the likely impacts of sustainability risks on the returns of the financial products they make available.

Where financial market participants deem sustainability risks not to be relevant, these descriptions must include a clear and concise explanation of the reasons why the financial market participant deems them not relevant.

The description of the integration of sustainability risks must be stated in the relevant pre-contractual information for the financial product in the manner referred to in Article 6(3) of the SFDR. In the case of AIFMs, for example, this description must be included in the information they make available pursuant to Article 23 (1) of the Alternative Investment Fund Managers Directive (AIFMD), i.e. in the manner set out in the AIF’s rules or instrument’s of incorporation. This information is usually provided in the prospectus. It is different, however, for registered managers, as they are not required to draw up a prospectus for a domestic collective investment undertaking as defined in Section 4(2)(b) of the Slovak Collective Investment Act. In their case, NBS expects the relevant information to appear directly in the managed entities’ founding documents (articles of association, memorandum of association).

Where a financial product promotes, among other characteristics, environmental or social characteristics, or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices, the financial market participant is required to publish the information about this financial product pursuant to the SFDR (Article 8) and to the SFDR Delegated Regulation (Section 1 of Chapter III, Section 1 of Chapter IV, Section 1 of Chapter V).

Where a financial product has sustainable investment as its objective pursuant to Article 9(1) or (2) of the SFDR or has a reduction in carbon emissions as its objective pursuant to Article 9(3) of the SFDR, the financial market participant is obliged to publish information about this financial product pursuant to Article 9 of the SFDR and to Section 2 of Chapter III, Section 2 of Chapter IV and Section 2 of Chapter V of the SFDR Delegated Regulation.

On a voluntary basis, financial market participants disclose, pursuant to Article 7 of the SFDR, information about whether a financial product considers principal adverse impacts on sustainability factors.

-

Can a financial product promote sustainability or ESG characteristics without disclosing information referred to in Article 8 or Article 9 of the SFDR?

No, it cannot. If a financial product promotes sustainability or ESG characterstics, it will fall under the sustainability-related disclosure regime laid down in either Article 8 or the Article 9 of the SFDR.

-

Where can I find out more about sustainability-related disclosures by financial market participants?

Further information on sustainability-related disclosures by financial market participants can be found on the websites of the European Commission and ESMA.

Additionally, consolidated questions and answers on the SFDR compiled by the European Commission, ESMA, EIOPA and EBA can be found on the ESMA website here and on the EIOPA website here.

-

Sustainability preferences of investors

Consumers have an option to make an investment, take out a loan, conclude an insurance policy or select a pension product that finances companies or projects that act in a socially responsible manner or contribute towards protecting the environment and the transition towards a more sustainable economy. When consumers make any of these choices, their sustainability preferences should be matched to a suitable product.

-

How to make financial decisions in a sustainable way?

This factsheet provides answers to frequently asked questions and outline steps consumers can take to better understand how their financial decisions can contribute to a more sustainable future. Consumers are advised to:

- decide how important sustainability is to them and what financial goals they want to achieve before choosing a product;

- pay attention to the conditions and sustainability features to avoid being misled by ‘greenwashing’;

- keep in mind that financial products with sustainability features are not risk-free;

- take their time before deciding about investments and life insurance and, if need be, seek further clarification.

More information can be found here (in Slovak only).

-

Must consumers be asked about their sustainability preferences before purchasing a financial product?

Investment firms providing investment advice and portfolio management are required to carry out a mandatory assessment of their clients’ or potential clients’ sustainability preferences. A similar obligation applies to financial agents and financial advisers providing insurance advice with regard to insurance-based investment products (IBIPs) or providing investment advice.

Investors who express sustainability preferences in the mandatory assessment—whether specific preferences or a simple desire to invest in a sustainable manner—can be offered a suitable product that aligns with these preferences as well as with the other choices they make in the assessment.

Further information on the consideration of clients’ sustainability preferences when providing investment advice or portfolio management can be found in the ESMA Guidelines on certain aspects of the MiFID II suitability requirements as well as in NBS’s Frequently Asked Questions on MiFID II (in Slovak only).

-

Where can I find out more about investor sustainability preferences?

Further information can be found on the ESMA website and in the ESMA Guidelines on certain aspects of MiFID II suitability requirements.

-

How to make financial decisions in a sustainable way?

-

Greenwashing

Greenwashing is a practice where sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial services. This practice may be misleading to consumers, investors, or other market participants.

-

Is there a legal definition of a greenwashing?

No, there is no legal definition of greenwashing in the legislation of Slovakia or the European Union.

However, the three European Supervisory Authorities (EBA, EIOPA and ESMA – ESAs) have agreed upon a high-level understanding of greenwashing, defining it as ‘a practice where sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial services. This practice may be misleading to consumers, investors, or other market participants’.

Sustainability-related misleading claims can occur and spread intentionally or unintentionally. An action does not need to actually harm investors in order to be labelled as greenwashing. Greenwashing can occur in relation to entities, services, and products that are either under or outside the remit of the EU regulatory framework.

Further information on greenwashing can be found in the following ESA progress reports and final reports:

-

How can greenwashing occur?

Greenwashing can occur in various ways, including the omission of important information, ambiguity in claims, exaggeration, misleading use of ESG terminology in titles, or irrelevant or unsubstantiated claims.

ESMA states in its Progress report on greenwashing the following examples:

- Identifying clients with sustainability preferences within the positive target market of a product that does not have any sustainability features (in the design phase).

- An investment firm or financial adviser not taking duly into account clients’ sustainability preferences identified through an investment questionnaire (when providing investment advice or portfolio management).

- A financial product manufacturer correctly marketing a product as sustainable, but suggesting in its marketing communications that the manufacturer’s entire business is sustainable.

- A financial institution whose advertisements mention the positive environmental impact of its tree planting activity but fail to reference the bigger impact of its business-as-usual financing of the oil and gas sector.

- An issuer active in the fossil fuel sector that discloses net-zero commitments while continuing to invest in expanding fossil fuel supply.

- A benchmark administrator implying that an ESG result or metric (e.g. low carbon footprint relative to a broad non-ESG benchmark) is achieved as a direct consequence of the benchmark’s strategy whereas it might sometimes just be the result of the intrinsic characteristics of the investable universe or of the fund’s targeted asset classes and industries.

-

Can Národná banka Slovenska impose sanctions for greenwashing?

Yes, NBS is authorised to impose sanctions for greenwashing if a supervised entity’s greenwashing actions constitute a breach of its obligations arising under legislation of general application on matters falling within NBS’s supervisory competence. A list of legal provisions that NBS can use as a legal basis for imposing sanctions for greenwashing is provided in Annex 2 of the ESMA Final Report on Greenwashing.

-

Where can I find out more about greenwashing?

Further information on greenwashing can be found in the following ESA progress reports and final reports:

-

Is there a legal definition of a greenwashing?

-

Information for supervised entities in the banking sector

The NBS Banking Supervision Department follows the approach of the European Central Bank (ECB) in the area of sustainable finance. In a timely response to growing climate-related and environmental risks, the ECB published in November 2020 a Guide on climate-related and environmental risks (hereinafter the ‘ECB Guide’), which sets out ECB supervisory expectations for the management of these risks.

-

General principles on climate-related and environmental risks

The ECB Guide outlines ECB supervisory expectations regarding business strategy, internal governance, risk management and disclosures inrelation to climate-related and environmental risks. It explains the ECB’s understanding of the prudent management and transparent reporting of these risks under current prudential rules. Below is an overview of these expectations, divided into relevant processes:

Business strategy:

- Institutions are expected to understand the impact of climate-related and environmental risks on the business environment in which they operate, in the short, medium and long term, in order to be able to make informed strategic and business decisions.

- When determining and implementing their business strategy, institutions are expected to integrate climate-related and environmental risks that impact their business environment in the short, medium or long term.

Internal governance:

- The management body is expected to consider climate-related and environmental risks when developing the institution’s overall business strategy, business objectives and risk management framework, and to exercise effective oversight of climate-related and environmental risks.

- Institutions are expected to explicitly include climate-related and environmental risks in their risk appetite framework.

- Institutions are expected to assign responsibility for the management of climate-related and environmental risks within the organisational structure in accordance with the three lines of defence model.

- For the purposes of internal reporting, institutions are expected to report aggregated risk data that reflect their exposures to climate-related and environmental risks with a view to enabling the management body and relevant sub-committees to make informed decisions.

Risk management:

- Institutions are expected to incorporate climate-related and environmental risks as drivers of existing risk categories into their existing risk management framework, with a view to managing, monitoring and mitigating these over a sufficiently long-term horizon, and to review their arrangements on a regular basis. Institutions are expected to identify and quantify these risks within their overall process of ensuring capital adequacy.

- In their credit risk management, institutions are expected to consider climate-related and environmental risks at all relevant stages of the credit-granting process and to monitor the risks in their portfolios.

- Institutions are expected to consider how climate-related and environmental events could have an adverse impact on business continuity and the extent to which the nature of their activities could increase reputational and/or liability risks.

- Institutions are expected to monitor, on an ongoing basis, the effect of climate-related and environmental factors on their current market risk positions and future investments, and to develop stress tests that incorporate climate-related and environmental risks.

- Institutions with material climate-related and environmental risks are expected to evaluate the appropriateness of their stress testing with a view to incorporating them into their baseline and adverse scenarios.

- Institutions are expected to assess whether material climate-related and environmental risks could cause net cash outflows or depletion of liquidity buffers and, if so, incorporate these factors into their liquidity risk management and liquidity buffer calibration.

Disclosures:

- For the purposes of their regulatory disclosures, institutions are expected to publish meaningful information and key metrics on climate-related and environmental risks that they deem to be material, with due regard to the European Commission’s Guidelines on non-financial reporting: Supplement on reporting climate-related information.

-

Banking supervision activities in the area of sustainable finance

Národná banka Slovenska recognises the increasing importance of climate and environment risks at the national level. To address this, in 2022 the NBS Banking Supervision Department carried out its first assessment of banks’ readiness to manage climate-related and environmental risks. The objective was to identify differences between banks’ current practices and the expected practices on climate-related and environmental risks outlined in the ECB Guide.

In 2023, NBS carried out a follow-up to the 2022 assessment. The objective was to monitor the progress of banks that participated in the original assessment and to evaluate newly participating banks for their readiness to manage climate-related and environmental risks. The results from both assessments were presented at a meeting with the Slovak Banking Association.

In 2024, the ECB’s supervisory expectations set out in the ECB Guide were incorporated into the Supervisory Review and Evaluation Process (SREP). Under the SREP, climate and environmental risks will be assessed on an ongoing basis as a standard part of the annual assessment of banks.

-

Where can I find more information?

The European Central Bank (ECB):

- Climate change and SSM banking supervision

- Guide on climate-related and environmental risks

- Results of the 2022 ECB thematic review on climate-related and environmental risks

- Good practices for climate-related and environmental risk management

- A review of climate-related and environmental risks disclosures practices and trends

The European Banking Authority (EBA):

- Sustainable finance

- The EBA Roadmap on sustainable finance

- Report on the role of environmental and social risks in the prudential framework

Network for Greening the Financial System:

-

General principles on climate-related and environmental risks

Legislation

Further information regarding sustainable finance can be found on the websites of the European Commission and the European Supervisory Authorities (ESMA, EBA and EIOPA).

Important notice:

On 14 January 2026, the European Securities and Markets Authority (ESMA) published a Second Thematic Note on ESG Strategies (ESG exclusions and ESG integration) which purpose is to describe clear, fair & not misleading sustainability-related claims, while addressing greenwashing risks in support of sustainable investments. This thematic note follows on from the First Thematic Note on ESG Credentials.

On 14 January 2026, the European Securities and Markets Authority (ESMA) published an updated implementation timeline for the sustainable finance regulatory framework, comprising the Sustainable Finance Disclosure Regulation (SFDR), the Taxonomy Regulation (TR), the Corporate Sustainability Reporting Directive (CSRD), the Benchmarks Regulation (BMR), and the European Green Bond Regulation.

On 8 January 2026 the Commission Delegated Regulation (EU) 2026/73 of the EP and of the Council was published in the Official Journal of the European Union. This CDR amends the Delegated Regulation (EU) 2021/2178 as regards the simplification of the content and presentation of information to be disclosed concerning environmentally sustainable activities and Delegated Regulations (EU) 2021/2139 and (EU) 2023/2486 as regards simplification of certain technical screening criteria for determining whether economic activities cause no significant harm to environmental objectives. It shall apply from 1 January 2026.

On 30 December 2025, two regulations regulating external reviewers for European Green Bonds (EuGB) were published in the Official Journal of the European Union. The Commission Implementing Regulation (EU) 2025/2179 prescribes standard forms, templates, and procedures for the provision of the information for an application for registration as an external reviewer for EuGBs. The Commission Delegated Regulation (EU) 2025/2180 specifies the conditions for the registration of external reviewers, the criteria for assessing their sound and prudent management, the appropriateness of the knowledge, experience and training of their employees, and the conditions under which they can outsource their assessment activities. Both regulations enter into force on 19 January 2026 and are directly applicable.

On 6 November 2025, the European Commission published a Communication from the Commission C/2025/5885 with frequently asked questions (FAQ) related to the European Green Bond Regulation (EuGBR). The communication contains interpretation in relation to the use of the “European Green Bond” (EuGB) label, the use of proceeds, factsheets, other published information, and the external review.

On 9 September 2025, the Joint Committee of the three European Supervisory Authorities (EBA, EIOPA and ESMA – the ESAs) published the fourth annual Report on the extent of voluntary disclosure of principal adverse impacts (PAIs) under the Sustainable Finance Disclosure Regulation (SFDR). The ESAs have observed an improvement in the quality of the PAI voluntary disclosures at both entity and product level.

On 4 August 2025, the European Supervisory Authorities ESAs published a new version of the consolidated Questions and Answers to the SFDR Regulation.

On 31 July 2025, EFRAG published a public consultation in order to obtain the views and comments of interested parties on the new draft sustainability reporting standards (ESRS 2.0), which are being prepared as part of the Omnibus Simplification Package. ESRS 2.0 are intended to be a simplification of the ESRS issued on the basis of Commission Delegated Regulation (EU) 2023/2772. The deadline for submitting contributions is 29 September 2025.

On 30 July 2025, the Commission published voluntary sustainability reporting standards for SMEs (VSME) in the form of a recommendation. The VSME itself can be found in Annex I and the VSME guidelines can be found in Annex II. The Commission recommends that non-listed SMEs and micro-undertakings that wish to voluntarily report sustainability information do so in accordance with the VSME. The Commission recommends that undertakings subject to the requirements to mandatorily report under CSRD, where they need sustainability information from SMEs in their value chains for the purposes of sustainability reporting, should limit as far as possible their requests for such information to the information provided pursuant to VSME. The Commission recommends that banks, insurance undertakings and other financial market participants, where they need sustainability information from SMEs, should limit as far as possible their requests for such information to the information provided pursuant to VSME.

On 16 April 2025, the Directive (EU) 2025/794 of the EP and of the Council was published in the Official Journal of the European Union. This directive amends the CSRD Directive (see Article 1) and the CSDDD Directive (see Article 2) as regards the dates from which Member States are to apply certain corporate sustainability reporting and due diligence requirements. This directive is addressed to the Member States, which shall transpose it into national laws by 31 December 2025.

On 18 October 2024, the European Securities and Markets Authority (ESMA) published an updated implementation timeline for the sustainable finance regulatory framework, comprising the Sustainable Finance Disclosure Regulation (SFDR), the Taxonomy Regulation (TR), the Corporate Sustainability Reporting Directive (CSRD), the Benchmarks Regulation (BMR), and the European Green Bond Regulation.

On 7 August 2024, the European Commission published a document containing frequently asked questions on the implementation of the EU corporate sustainability reporting rules (CSRD).

On 25 July 2024, the European Supervisory Authorities (EBA, EIOPA, ESMA) published a new version of their ‘Consolidated questions and answers (Q&A) on the SFDR’.