-

Úlohy NBS

Prehľadávať témy

- Menová politika

-

Dohľad nad finančným trhom

- Oblasti dohľadu FinTech Ochrana finančného spotrebiteľa Legislatíva Zoznam dohliadaných subjektov Registre dohľadu Dokumenty na stiahnutie

- Iné zoznamy Oznámenia a upozornenia Výroky právoplatných rozhodnutí Výroky neprávoplatných vykonateľných rozhodnutí Publikácie, údaje, prezentácie Poplatky a príspevky

- Finančná stabilita

- Bankovky a mince

- Platby

- Štatistika

- Výskum

- Legislatíva

-

Publikácie

- Analytické komentáre Analýza návrhu rozpočtu verejnej správy Analytické štúdie (Policy Briefs) Blogy NBS Čo hovoria dáta Ekonomický a menový vývoj Frankfurtské hárky Klimatická správa o nemenovopolitickom portfóliu NBS Makroprudenciálny komentár Rýchle komentáre Správa o činnosti Inovačného hubu NBS

- Správa o činnosti útvaru dohľadu nad finančným trhom Správa o finančnej stabilite Správa o vývoji trhu s krytými dlhopismi Štatistický bulletin Štrukturálne výzvy Vyhlásenie o investičnej politike Národnej banky Slovenska Výročná správa Výskumné a príležitostné štúdie (WP/OP) Letáky a iné publikácie Prihlásenie na odber notifikácií

- O národnej banke

- Informácie pre médiá

- Časté otázky

-

Pre verejnosť

Prehľadávať témy

- O národnej banke

- Vzdelávanie

- Kurzy a úrokové sadzby

- Bankovky a mince

- Platby

- Finančná stabilita

-

Dohľad nad finančným trhom

- Upozornenia NBS Zoznam dohliadaných subjektov Registre dohľadu Poplatky a iné úhrady vyžadované bankou od klienta Ako postupovať keď ste nespokojní s konaním finančnej inštitúcie

- Finančné sprostredkovanie a finančné poradenstvo Výroky právoplatných rozhodnutí Výroky neprávoplatných vykonateľných rozhodnutí Legislatíva Vybrané údaje

- Štatistika

- Legislatíva

-

Publikácie

- Analytické komentáre Analýza návrhu rozpočtu verejnej správy Blogy NBS Ekonomický a menový vývoj Frankfurtské hárky Makroprudenciálny komentár* Rýchle komentáre Správa o činnosti Inovačného hubu NBS

- Správa o činnosti útvaru dohľadu nad finančným trhom Správa o finančnej stabilite Štatistický bulletin Štrukturálne výzvy Výročná správa Letáky a iné publikácie Prihlásenie na odber notifikácií

- Časté otázky

- Pre médiá

- Kariéra

- Kontakty

Rozhovor guvernéra P. Kažimíra pre agentúru Bloomberg

ECB’s Kazimir Backs End of QE in August, Flexibility on Hikes

- Summer lull would be ‘natural‘ timing to conclude purchases

- Slovak central bank chief urges new guidance on timing of hike

By Peter Laca and Alexander Weber

18. 2. 2022

(Bloomberg) — The European Central Bank should wind down net bond-buying in the summer, while giving itself more flexibility on the timetable for any subsequent interest-rate increase, according to Governing Council member Peter Kazimir.

The Slovak central bank chief said the tool — which was created to stave off deflation after Europe’s debt crisis and was expanded during the pandemic — has outlived its usefulness. The ECB doesn’t have a firm end date for its regular purchases, known as APP.

„The risks this instrument was designed to address have subsided, while on the other hand the negative side effects are becoming more significant,“ Kazimir said Thursday in an interview. „Trading activity weakens in August so that would be a good natural timing for ending the program.“

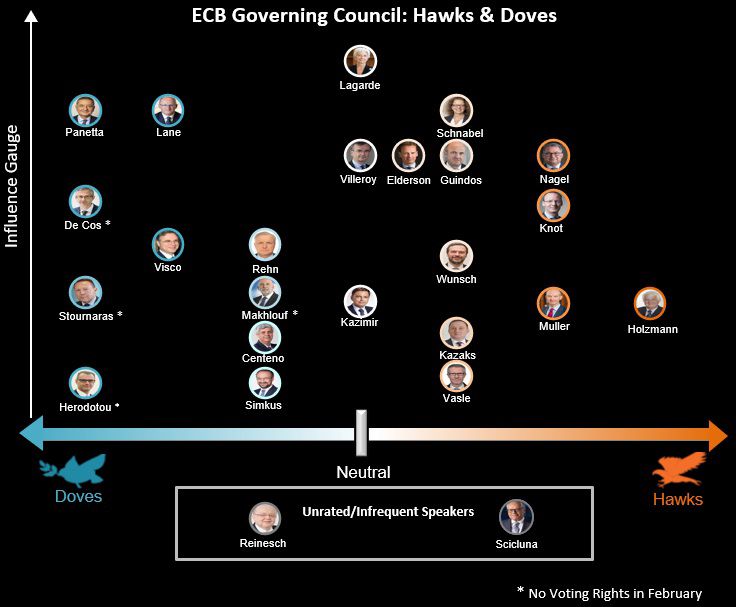

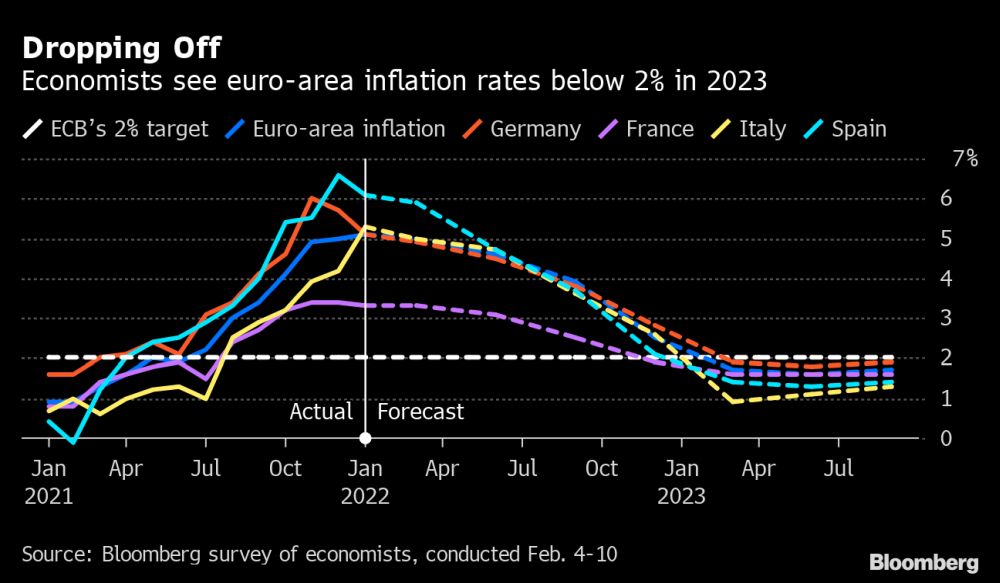

Facing unprecedented euro-area inflation, ECB officials have fallen into agreement on the need to pare back support measures that include record-low interest rates and a second bond-buying program deployed when Covid-19 struck and due to end in March. Where they differ is on the speed at which the shift should happen.

Source: Bloomberg Economics

Kazimir’s proposal for ending APP is the most specific since ECB President Christine Lagarde signaled a tougher stance to soaring prices this month. His timing chimes with Francois Villeroy de Galhau, who said this week that purchases could finish in the third quarter.

Both officials suggest a change to the ECB’s forward guidance that currently calls for interest rates to rise „shortly“ after asset purchases are concluded. Doing so would provide more „optionality,“ according to Villeroy.

„It’s time to start thinking about separating the two,“ Kazimir said. „Phasing out asset purchases should free our hands and give us room to find the most appropriate timing for returning to rates as the standard monetary-policy tool.“

Other officials have urged caution in reacting to inflation that many economists still predict will come in below the ECB’s 2% target in the next two years. Spain’s Pablo Hernandez de Cos said Thursday he sees „no reason to overreact.“

Chief Economist Philip Lane echoed that line later on, while also saying the ECB shouldn’t tolerate under-reactions to emerging inflation risks.

By contrast, other Governing Council members are keener to follow the Bank of England and the Federal Reserve in raising rates. They include Germany’s Joachim Nagel and the Netherlands‘ Klaas Knot, who’ve floated the idea of a hike as soon as this year.

Investors are betting on two quarter-point increases by the end of 2022, though Latvia’s Martins Kazaks said this week in an interview that such a scenario is „somewhat too harsh.“ Liftoff is nevertheless „quite likely“ this year, he said.

The challenge for policy makers is that inflation is being driven by factors including high energy prices and supplychain bottlenecks that have lasted longer than initially thought. While the pressure is still expected to ease, unpredictable events like the tensions between Russia and the West over Ukraine are muddying the outlook.

„Our road-map toward monetary tightening still has some blank points that represent risks, and we’ll need more data that will decide whether or not a rate increase will be needed already this year,“ Kazimir said. „I have no doubts that we’re headed toward monetary tightening, but I’d advocate for a path of gradual steps.“