Nezvyčajné rozdiely medzi vnímaním inflácie a inflačnými očakávaniami v Európe (v angličtine)

Europe’s unusual divergence in inflation perceptions and expectations

- Perceived inflation is still high, but expectations about the future evolution of prices drop significantly

- Credibility of policy commitments could be a reason but alternative narratives about expectation formation are possible too

- Important policy lessons here and deep dive is warranted

It is widely acknowledged that household inflation expectations not only tend to exceed official inflation rates, but also that perceptions of inflation play a pivotal role in shaping these expectations[1].

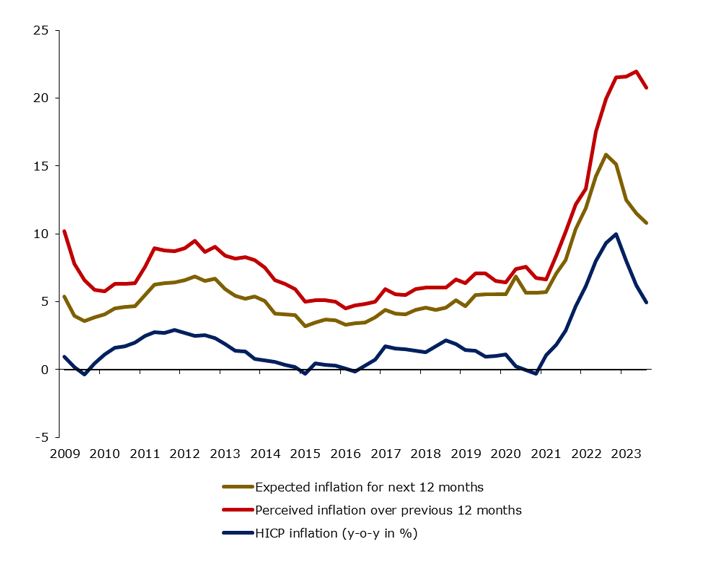

Before the recent substantial surge in inflation, perceptions and expectations of inflation were closely synchronized in most European and Eurozone countries, including Slovakia. It is noteworthy that perceptions and expectations of inflation remained closely aligned even during the significant inflation increase.

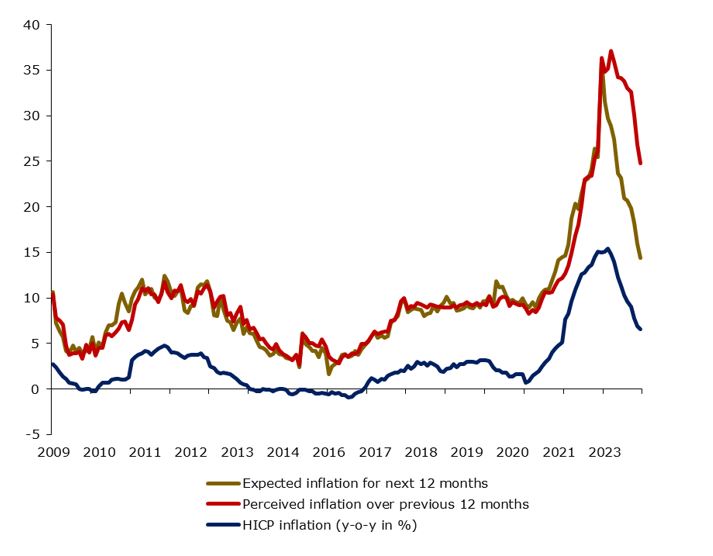

However, after inflation reached its peak, a significant divergence between the two emerged. While perceptions of inflation have stayed high, expectations have started to decrease rapidly. This trend is consistent across Europe, as illustrated in Figures 1 and 2.

Figure 1 Official, perceived and expected inflation by households in Slovakia (in %)

Figure 2 Official, perceived and expected inflation by households in the Eurozone (in %)

Several potential explanations exist for the decoupling between perceived and expected inflation. One possibility is that people are noticing high prices in their daily lives, which makes them feel like inflation is high. This may be due in part to households interpreting inflation not as a rate of change in prices, but rather as a cumulative increase in prices. However, their expectations for future price increases are lower. This is partly because the markets for everyday items like food and energy have become more stable. Additionally, with credible monetary policy interventions to control inflation, people trust that the central banks‘ actions will effectively reduce inflation.

Another possibility is that people are more optimistic about the future in general. Research has shown that people tend to associate high inflation with adverse outcomes, such as a bad economic or financial situation[2]. Having more hopeful expectations about the future might result in lower inflation expectations, despite viewing current times pessimistically.

Consequently, despite a substantial decrease in their inflation expectations, households continue to struggle with high levels of perceived inflation. This situation shows that what people feel about prices today and what they expect for tomorrow can be quite different, influenced by a mix of actual price changes, government policies, and their own hopes and fears.

Given that inflation expectations substantially impact household decisions, especially in terms of current versus future consumption or wage demands, it is crucial to understand the mechanisms through which individuals form their inflation expectations. The rather interesting pattern identified in this blog surely deserves more formal investigation which could deliver important policy lessons.

Figures – Data – Blog – What lies behind the unusual divergence in inflation perceptions and expectations.xlsx

68.82 kB[1] The strong correlation between perceptions and expectations goes back to at least Jonung (1981, Perceived and expected rates of inflation in Sweden, The American Economic Review 71 (5)) and is extensively discussed inter alia in Weber et al. (2022, The Subjective Inflation Expectations of Households and Firms: Measurement, Determinants, and Implications, Journal of Economic Perspectives 36 (3)) or Marencak (2023, State-dependent inflation expectations and consumption choices, NBS Working Paper 10/2023).

[2] See, for instance, Shiller (1997, Why do People Dislike Inflation? In Reducing Inflation: Motivation and Strategy, edited by Christina D. Romer and David H. Romer, chap. 1, 13–70. Chicago, IL: University of Chicago Press.) or Candia et al. (2020, Communication and the beliefs of economic agents, NBER WP 27800).

Mailing list: v prípade záujmu o zasielanie notifikácií o ďalších blogoch sa prihláste do mailing listu NBS.